Average office occupancy across Europe in June 2022 was 43 per cent, down from an estimated 70-75 per cent prior to the pandemic. As businesses grapple with the impact of new hybrid ways of working and, in some cases, a slower-than-wished-for return to the office, the transport system and commuter costs of our cities is coming under scrutiny.

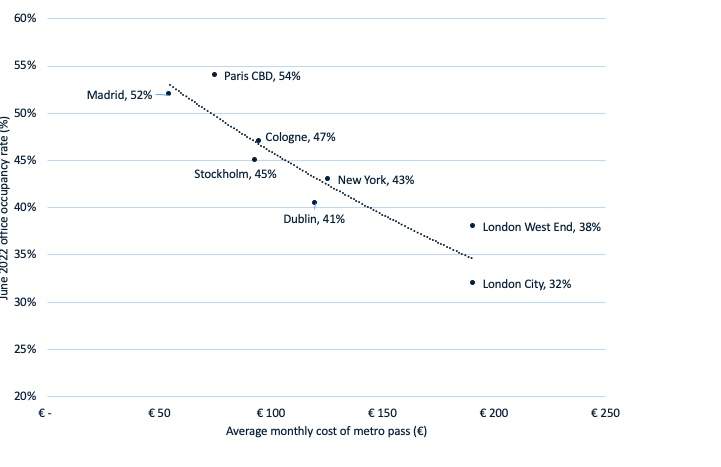

Across Western Europe, there is a strong case to suggest that higher public transport costs are having an impact on occupancy rates, with a very strong correlation between lower costs and more people returning to the office.

For example, Paris CBD (54 per cent occupancy rate) and Madrid (52 per cent) have Western Europe’s highest occupancy rates and lowest average monthly metro costs of €75 and €55 respectively. At the other end of the scale, London City’s occupancy rate of 32 per cent is constrained by average monthly Underground costs of €191. In Luxembourg, public transport has been free since 2020.

In an environment of rising living costs and record inflation across Europe, could government subsidies on public transport help to boost office occupancy rates?

Office occupancy over the remaining six months of 2022 will be interesting to watch across Europe. In Spain, a free commuter travel policy is to be extended in August for four months, covering short and mid-length journeys in a bid to help commuters against a rising cost of living. While the policy drivers for Germany and Austria, where there is also subsidised and/or free public transport, have been introduced on environmental grounds rather than returning workers to the office, they may have the same effect.

While cost of travel is one factor, reliability and cleanliness of transport is perhaps another. Looking further afield. commentators have recently said – in the Financial Times – that the poor condition of New York’s subway is partially responsible for why the city has seen low to middling return to the office rates, having faced reduced investment and poor planning on and off for decades (albeit the NYCT Subway is still cheaper than the London Underground). Anecdotal evidence this may be, but it’s a powerful message to any public body looking at withdrawing funding from city transport projects.

The authorities in Washington DC seem to have heeded the warning signs pre-Covid-19 and in 2018 announced a $400 million programme of works and upgrades of its Metro lines and stations after suffering similar reliability issues as New York. The planned improvements are due to fully complete later in 2022, at which point all parties involved will be hoping they boost office occupancy levels above the current 40 per cent mark.

Rising construction and maintenance costs, an inability to secure raw materials, and labour shortages will of course continue to act as a headwind for the transport industry to operate at full capacity in the short/medium term. Yet contrary to this, these same rising energy costs and Russia limiting supply of natural gas to countries such as Germany, could also encourage workers back into offices as they try to avoid heating and powering their own homes through the winter months.

The impact average commute cost by public transport could be having on office occupancy rates:

(1).jpg)

.jpg)

.jpg)