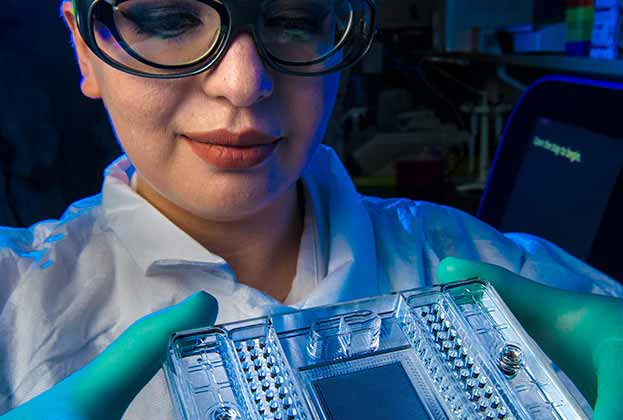

In London property circles 2021, and 2020 before that, was characterised by a mass gathering of information on the life science sector. This was in train before Covid-19 struck, driven by increased healthcare spend globally, scientific discovery and the UK’s aging population, although of course the pandemic has played a contributing role in the sharpening of focus.

There’s been a lot of discussion around the definition of the sector; the specification of space and who would occupy it; debate around demand, and comparisons with traditional office space from a space efficiency, build cost and rent premium perspective. How could existing office space be retro-fitted (as Gyroscope did at Rolling Stock Yards, N1, or Autolus at White City Place, W12), or new schemes future proofed through lab enablement and adaptability?

The challenge for developers to date has been rationalising a lack of historic take-up data with addressing supply shortfalls in a market where the existing demand might have high growth potential, but remains small scale in nature and early stage in enterprise terms. Such demand is therefore largely unable to pre-commit to space.

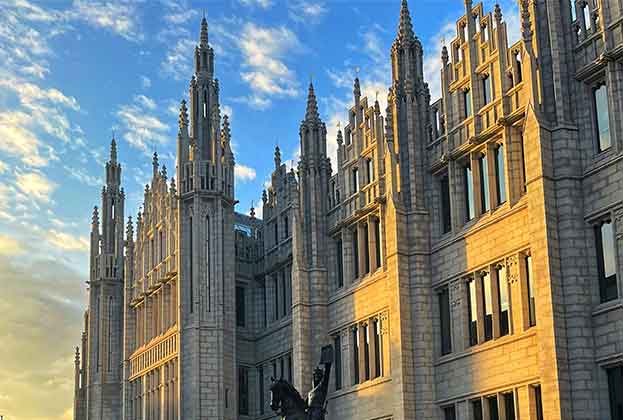

Local planning authorities that host principle or potential emerging clusters have similarly been on a learning curve, albeit some more so than others. This has been particularly in terms of the requirements of a commercial life sciences market cluster versus those of the institutional facilities that form part of London’s traditional healthcare and educational infrastructure. Crucially, success will depend on creating and curating the right ecosystem.

The education process is ongoing, but as projects move through planning and into delivery stage, first-hand knowledge and experience across landowners, developers and institutions is building.

We have started to see some capital markets evidence in London. Pricing was keen, following the levels seen in much more established markets in Cambridge and Oxford. 2022 is likely to be a big year and the view from the coalface is that there is now a substantial list of life science occupier requirements for London which need to be satisfied in the short term.

We should start to see the first genuine life science-led development opportunities transact. This will be triggered by an important ‘pump priming’ role of a handful of forward-looking institutions. They are promoting opportunities with the specific objective of securing delivery of space that will cater to these requirements as well as their respective ‘homegrown’ demand.

Such entities are able to attach value to the commercialisation of academic IP (intellectual property) and R&D (research and development), meaning they have key drivers over and above traditional commercial real estate return metrics. We are also seeing an uptick in appetite and activity from some of the US life sciences heavyweights.

This does not mean that the London landscape is about to transform overnight. Life sciences will likely remain a minority subset of the mainstream commercial market. However it does look like this will be the next stage of market evolution. Crucially it will likely start to show more evidence to support the value growth potential of the sector in key geographic spots around the capital.

Further information

Capital raised by UK life science firms in London hits £2.4bn in 2020

.jpg)

.jpg)

.jpg)

.jpg)