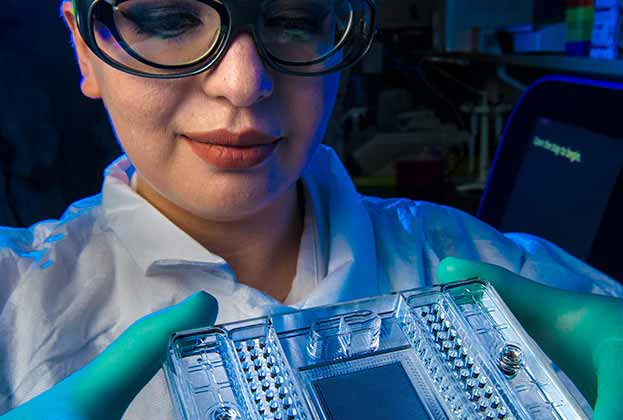

The last two years have shone a spotlight on the strength and depth of the UK’s science market. While Covid-19 has undoubtedly played a role, there are longer term structural factors underpinning the sector such as an aging population, the accelerating pace of scientific discovery, emerging areas of medicine and increased healthcare spend globally.

2021 saw science real estate make some big strides forward, with new markets emerging, occupier demand growing and some landlords starting to take a much more innovative approach to delivering the right types of space.

Huge opportunities for pioneering landlords and developers

We have seen enormous appetite from real estate investors, with an estimated £10 billion of live capital chasing UK science-led opportunities.

In London, for example, availability within the existing science clusters is hampered by site constraints and competition from more established uses. Consequently, this will see the emergence of new fringe locations in places like east London and Southbank. There will undoubtedly be winners and losers as more supply is delivered and markets mature. Crucially, it’s not just about location, it’s about creating the correct ecosystem.

The growth of occupier demand

The number of venture capital (VC) backed biotech firms progressing beyond seed funding has increased 300 per cent over the last five years, fuelled by growth sectors such as AI, personalised medicines, microbiome therapies, genomics and vaccine technology.

We are already seeing occupier demand ramping up in 2022, with 750,000 sq ft of live requirements currently focused on London. With a large proportion of these from early stage biotechs, this suggests demand in the medium term will increase significantly as big pharma and service providers relocate to capitalise on proximity to new and expanding companies.

In more mature markets such as Oxford and Cambridge, there is record demand with some occupiers struggling to secure space. We will also see further requirements for manufacturing facilities in out of town locations, as more companies look to commercialise their products.

Speculative development of purpose built R&D space in more locations

This growing appetite will lead to a greater amount of speculative development of R&D space, which is already being seen as schemes get underway across the UK. These include Kadan’s 114,000 sq ft Brandan Road scheme just north of King's Cross, Arlington Brookfield’s 250,000 sq ft Manbre Wharf in Hammersmith, Reef Group’s Tribeca scheme, also in King's Cross, Bruntwood SciTech and Birmingham University’s 600,000 sq ft Birmingham Health Innovation Campus, and St Johns College’s circa 1 million sq ft Oxford North Scheme.

The emergence of lab premiums

This in turn will mean the emergence of lab rental premiums. We are just starting to see the very first transactions on pre-built incubator and grow-on lab space in London outside of an academic facility, showing premiums over office space of up to 70 per cent. As more deals are done in 2022, it will provide the evidence to make underwriting lab-enabled schemes much easier.

Regional markets to watch

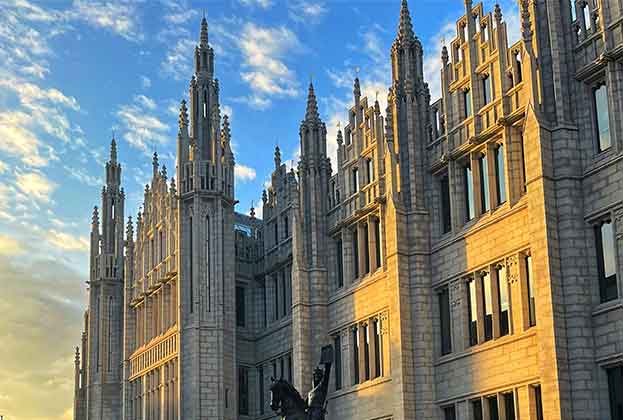

There’s no doubt that London will become a key market for science this year, while Oxford and Cambridge will continue to mature. We will also see growth of other regional centres such as Birmingham, Manchester, Edinburgh, Glasgow, Bristol and Stevenage, all of which already have many of the elements necessary for successful science ecosystems.

Further information

Savills appoints Tom Mellows to spearhead expanding science capability

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)