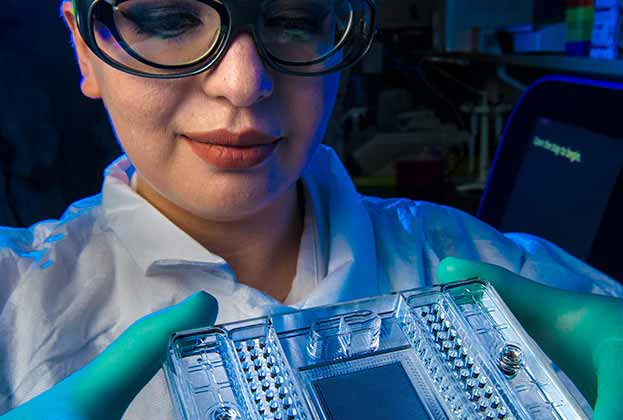

The life sciences sector was already gaining momentum and expanding at pace across the globe prior to the pandemic, but it has now been propelled into the limelight with vaccines being developed at record pace.

In line with this, we have seen record funding injected into the sector with venture capital investment increasing by 69 per cent last year, according to Savills Science Cities report. While this is hugely positive for the sector, the rapid growth has impacted life sciences occupiers across the spectrum, from newer start-ups to more mature institutions, in terms of how they progress, compete and maintain relevance in an ever-evolving arena.

A huge part of this is the race to retain and attract new talent and the associated cost and decisions that accompany this. Workers are most likely to be drawn to employers where they will receive the highest return on the investment into their educations and skills, which is ultimately a higher salary.

Savills Science Cities research shows that, while Basel in Switzerland recorded the highest salary for scientists within the ranking of 20 top science cities, seven of the top most expensive locations are in the US.

Conversely, the least expensive locations to hire workers are in the UK and China. A scientist’s salary in Cambridge, UK is 46 per cent lower than the same role in Cambridge (Boston) in the US, and 27 per cent lower than the all-city average. The discount is even greater in the case of Oxford, which demonstrates the comparative value of UK markets for a similarly skilled workforce.

For life sciences employers, the cost of securing a highly skilled workforce needs to be balanced against performance, success and other overheads. There are also external factors that need to be considered such as living costs for their employees.

For many scientists, their salary needs to be relative to their associated living costs. Residential rental costs are hugely relevant as affordability can be a deciding factor in where an employee, particularly younger ones coming out of university and into the industry, decide to settle. Those cities that offer a thriving and successful environment with a growing and competitive life sciences market, are also likely to present affordability challenges as a result.

The physical space that a life sciences occupier offers is, of course, a vital factor in attracting and retaining a highly skilled workforce. While comfort and a high specification remain important, other elements such as sustainability, wellbeing and facilities are also soaring up the priority list for employees.

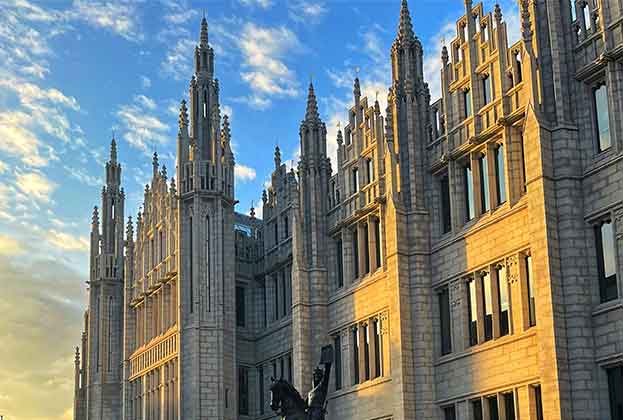

Location is also key. For life sciences organisations being close to major research universities and institutes allows them to capitalise on the innovation, talent and startups coming from these establishments. However, employees are also looking for a location that allows easy access to public transport and is close to local amenities.

There’s no doubt that there is a complex and delicate balance for life sciences occupiers to strike in a bid to remain attractive and competitive in a continuously progressing market. But one thing that is definitely clear is that their real estate location has never been more important in the war for talent.

Further information

Contact Savills Worldwide Occupier Services

.jpg)

.jpg)

.jpg)

.jpg)