From Asia-Pacific to Central and Eastern Europe, there are growing signs of opportunistic investors marshalling capital to take advantage of any significant real estate price corrections from the Covid-19 pandemic. So far, they have been disappointed.

Preliminary investment volumes in the CEE region totalled approximately €3.7 billion in Q1, which was an increase of 68% from the year-earlier period. The strong performance in Q1 was driven in part by a lag effect from the previous quarter, with many large deals initiated in the latter part of last year only completing at the start of this year, notably the €1.3 billion acquisition of the Residomo portfolio in the Czech Republic by Heimstaden. As such, the full impact of the pandemic won’t be seen in the statistics until Q2.

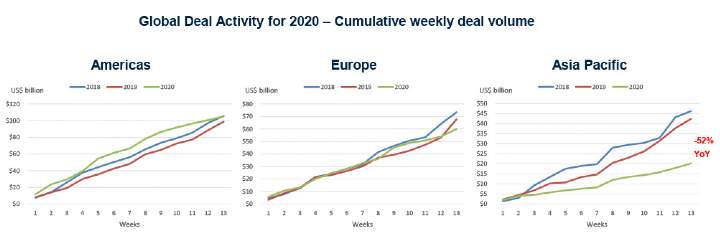

Looking at Asia-Pacific’s real estate activity in Q1 gives a window into how CEE might fare in Q2, given that the coronavirus outbreak originated in the region and so is further along the curve. Asia-Pacific investment volumes plunged 52% year-on-year in the first 13 weeks of 2020, similar to the declines seen during the global financial crisis of 2008. All markets except South Korea experienced drops in volumes because of the coronavirus outbreak. Japan, the most active Asia-Pacific market in Q1, saw its volumes fall by 45% y-o-y to $6.14 billion. China was down 65% y-o-y, while Hong Kong, Singapore and Malaysia all plunged by over 75% y-o-y. Volumes in 2020 could fall significantly further if the Covid-19 situation cannot be contained and resolved as we move into the second half of the year.

However, while it is clear some capital is retreating from the Asia-Pacific region and investors are becoming highly risk averse, Simon Smith, Savills Head of Research & Consultancy in Hong Kong, says most investors are adopting a wait-and-see attitude at the moment. He also highlights significant amounts of “dry powder” – fast-moving capital from private equity and family offices – that is waiting for any significant price corrections or any levels of distress in the region.

Yet, so far at least, it is volumes that have taken a hit rather than values, with the prices of assets generally holding up. “Up until this point, many of these types of funds have been disappointed,” Smith notes.

That situation is being mirrored here in Europe. On 8th April, Blackstone closed its BREP VI fund at €9.8 billion, the largest ever real estate fund with a sole focus on Europe, while Czech investment group DRFG is reportedly planning an CZK850 million bond issue this month, with the proceeds to be used to buy commercial and retail real estate.

Yet these opportunists waiting for price corrections in CEE real estate risk being disappointed. If banks are playing ball by delaying annuity repayments, then this will limit any levels of distress that might force owners to sell, especially when there appears to be a finite end to the crisis affecting ultimate income. While banks will surely become more cautious in lending, which will slow transactions and overall volumes, this is unlikely in itself to lead to mass price corrections.

Indeed, it could be argued that the amount of capital targeting CEE real estate hasn’t generally changed. There seems to be a misconception by some segments that still having equity provides a unique selling point. On the contrary, the market is still liquid and we see the smart equity, generally operating in the core and core-plus sector, using this time to move quickly and fluidly on deals where competitive tension in those processes has gone.

Whilst prices might have softened, yields are not so vastly different to before and certainly do not show any sign of major corrections.

.jpg)