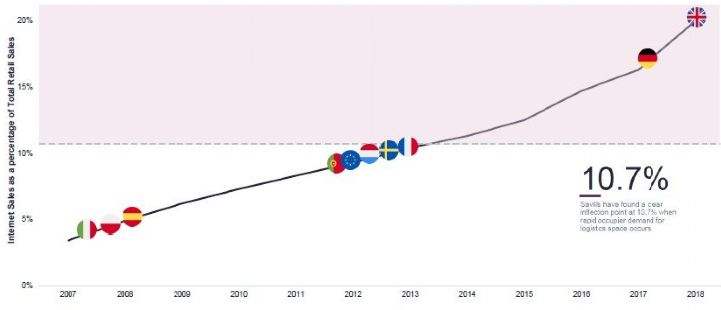

Although penetration rates may seem low across Europe at present, there is double digit growth in online sales across the continent and a number of countries such as The Netherlands, Sweden and Denmark, with over 90 per cent of the population having used the internet in the last 12 months, according to the Ecommerce Foundation. Significant growth within the European logistics markets is therefore inevitable.

From a practical perspective, some countries are struggling to find enough space in suitable locations – in Spain alone, vacancy levels have already fallen by 2 per cent in the last year with rents soaring as a result.

However, it isn’t just traditional warehouse space that is of interest. Online giant Amazon hit the headlines last year for looking at underutilised high street and out-of-town assets in the UK as last mile delivery hubs in an attempt to keep up with demand.

Alongside Amazon, some of the world’s largest investors are looking at retail properties to service urban logistics demand. M7 Real Estate has been particularly active in the retail park market in the UK already and, together with Blackstone, it is one of a number of large investors focused on smaller warehouses in urban European locations.

Shopping centres are also being modified from traditional physical retail spaces to click and collect hubs, and there is every chance struggling department stores will be broken up for precisely the same thing. So can we expect to see the same happening across continental Europe? In a word (or two): most probably.

The future is most definitely omnichannel. The hurdles of high levels of returns, the ease of cost comparison, increased inventory holding costs and maintaining consumer loyalty through offering a good experience are all challenges that retailers need to overcome to be successful going forward and real estate strategies form a major part of this.

Further information

Read more: The outlook for the UK's industrial and logistics market in 2019

.jpg)

.jpg)

.jpg)