House price growth has dramatically increased the wealth of home-owning households over the past 50 years but the rate at which it has been accumulated has slowed since the mid-Noughties.

The brakes went on in 2004. Prices had doubled in under five years at that point, and thereafter the ability to store up further wealth became much more limited. From taking just 4.75 years to double your money, the wait began to stretch. By the end of 2018 you would have needed to have owned your home for 16.5 years to see a 100 per cent increase in value – the longest period since at least the late Sixties.

It’s more or less the same picture regardless of where you live. Figures from Nationwide reveal surprisingly little regional variation – London had a slightly shorter average wait of 14.5 years, while for homeowners in Northern Ireland it took 18.75.

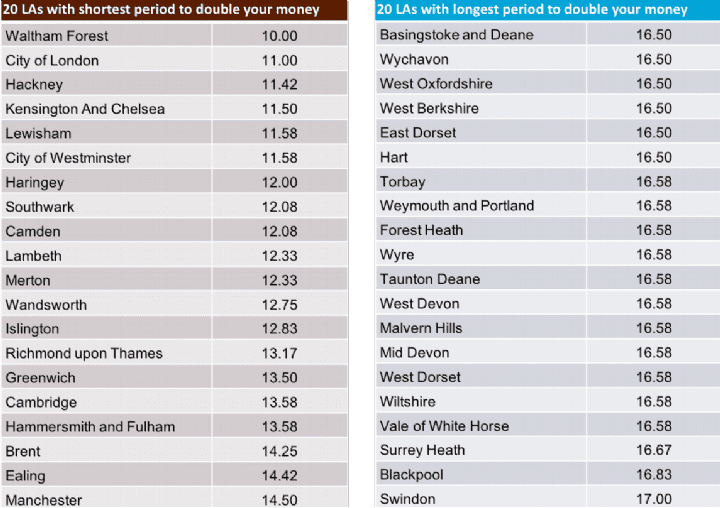

Different stats – this time from the Office for National Statistics – home in on the local authorities of England and Wales. They show a slightly briefer average wait of 15.7 years, ranging from the shortest period of ownership needed – 10 years in Waltham Forest – to the longest – 17 years in Swindon, partly reflecting where we are in the property cycle. Outside the capital, Cambridge and Manchester come top with just 13.58 and 14.5 years respectively.

Just as 2004 marked a change in the length of time needed to build up equity, it also saw a divide in terms of who was able to benefit, as it became much more difficult for the young to get a foothold on the housing ladder. The credit crunch entrenched these trends and has also meant people have been able to trade up less often, having less accumulated housing wealth behind them.

With future house price growth likely to be limited by the twin forces of gradually increasing interest rates and mortgage regulation, it looks as though doubling your money in the housing market is going to be an increasingly long-term venture.

That will make some younger households more comfortable with renting for longer. However, even if the gains of the past are unlikely to be repeated, the memory of how it used to be goes some way to explaining why the appetite for home ownership remains so strong.

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)