It has never been a better time to build new offices in Glasgow. For a city that has long lived in Edinburgh’s shadow, Glasgow is on the cusp of significant change with notable investment and evermore developers breaking ground on transformative developments.

In an ‘alignment of stars’, various factors at play have combined to create a strong argument to build. These include:

- Edinburgh’s constrained development pipeline forcing some occupiers in the Scottish capital to look to Glasgow as an alternative for their office relocation. Glasgow offers more available, good quality offices at lower rents. Businesses including The Open University, which is currently in Edinburgh, are therefore widening their search. We may see more Edinburgh occupiers doing the same. The upgrade of the rail link in 2019 that will reduce the journey time between the two cities to 42 minutes will only accelerate this trend further.

- Large occupiers, including Barclays, Morgan Stanley and Clydesdale bank, are expanding in Glasgow, breathing new confidence into the market. Significant office lettings in 2018 contributed to a stellar year in terms of take-up, and this looks set to continue with AECOM, Atkin, and GPA all active in the market.

- Inward investment from the Scottish and UK Government:

- As part of the Glasgow City Region City Deal funding, Glasgow City Council is investing approximately £115 million, a proportion of which is in the city centre in The Avenues Concept. The dynamics of Glasgow’s occupier market, and the shortage of good quality office space in the city centre, has long made a strong argument for the need to develop. However investors visiting the city were sometimes left underwhelmed by the poor streetscape, busy roads, congestion and broken pavements. Government investment will help rectify this.

- The UK hub project will see HMRC move 2,700 staff to Glasgow by 2021, which will increase further when GPA 2 takes shape.

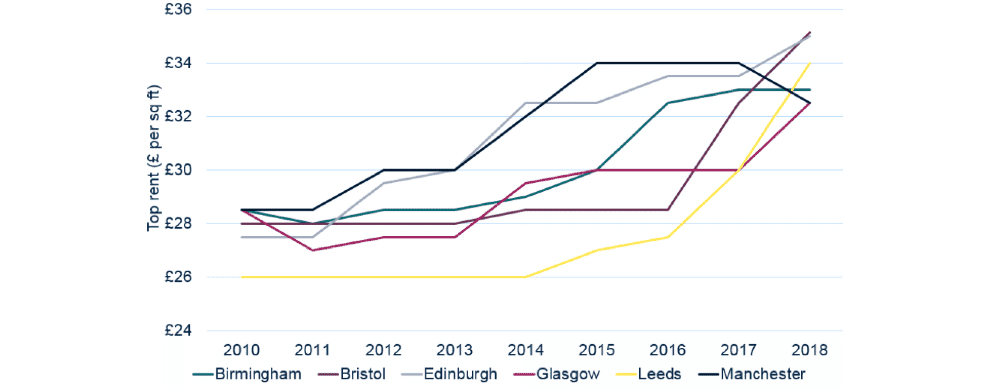

- Rents in the city moving up, but with room for further growth as Glasgow continues to trail behind other UK regional cities (see Big six top rents, below). Headline rents for new Grade A space were £29.50 per sq ft but are now £32.50 per sq ft. Perhaps more telling are the rents for refurbished space, with around £30 per sq ft achieved at 191 West George Street recently. With comparative new build offices in Edinburgh being marketing at £35 per sq ft this suggests further opportunities for landlords to capture value. Cost-savvy occupiers should make plans now while the relative rental discount remains.

The outcome is that a number of new office developments are underway in the city. Cadworks (Fore Partnership) will provide one of the first speculatively developed offices in the city in many years and close to 100,000 sq ft of Grade A offices from Q1 2021. A planning application to develop a new office that will become the gateway into Glasgow’s International Financial Services District (IFSD) extending to potentially 284,000 sq ft at One Central, Argyll Street (Osborne & Company) has been submitted, with speculative funding being explored.

LandSec is exploring developing 100,000 sq ft offices and 25,000 sq ft of new retail on Buchanan Street/Dundas Street.

These developments will reposition Glasgow’s offices market, helping change the face of the city overall. Investors and occupiers need to act now if they are to capitalise on opportunity.

Big Six Top Rents

.jpg)

(1).jpg)

.jpg)

.jpg)