The average European vacancy rate was at 6.1 per cent in Q3 2018, down from 6.9 per cent at the end of 2017, and we estimate that it dropped as low as 5.9 per cent at the end of 2018.

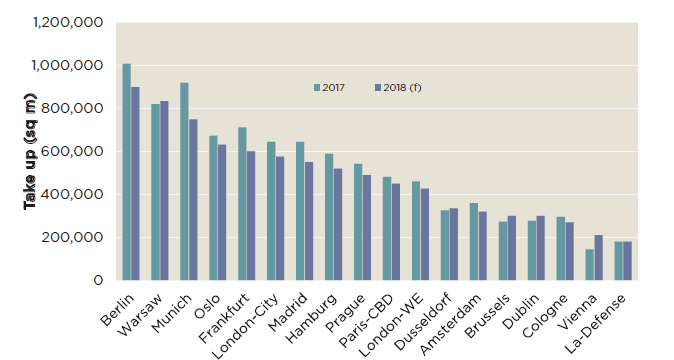

Berlin (1.4 per cent), Hamburg (4.5 per cent), Munich (2.5 per cent) and Stockholm (3.0 per cent) have almost no available office space and, as a result, we expect rents to continue to rise in these cities. Further pressure will come from the large number of new office jobs that are expected to be created on the continent.

Across the EU member states, professional science and tech will be the fastest growing office-based sector in 2019, with employment growth expected of approximately 1.8 per cent. This indicates that around 280,000 net additional jobs will be created in this sector over the next 12 months, creating upward pressure on office rents, as competition for prime stock intensifies.

Berlin experienced over 15 per cent prime rental growth in 2018, followed by Oslo (10.9 per cent) and Paris (9.7 per cent). We anticipate prime offices in Frankfurt, Barcelona and Dublin, in particular, to become even more expensive for occupiers in 2019, with increases of 6.6 per cent, 6.4 per cent and 6.3 per cent respectively.

As workplace environment is core to the attraction and retention of talent for most companies, competition for prime buildings is set to continue throughout 2019. Alongside rising rents, we therefore expect reduced incentives in many core European markets. These conditions favour landlords whereas tenants will need to plan further ahead and also consider more creative and potentially flexible office solutions.

One option we’re seeing is companies taking out long-term contracts in prime city locations to prepare for the future. For example in Amsterdam, Savills recently advised DAZN (part of Perform Group), a media group leading in the field of digital sports content, who signed a new lease agreement with Bridges Real Estate at Huidekoperstraat 26-28 for 10 years (pictured above). The lease agreement commences on 1 April 2019 and comprises 3,246 sq m of office space. The new location in Huidekoper will be their European Development Center.

In Dublin, San Francisco tech firm Zendesk moved to a bigger, improved building very close to its old building in order to attract more talent. It invested heavily in the fit-out of the space to include music rooms, fully stocked kitchens and mother-and-baby rooms for their staff.

While vacancy rates remain low, it is a landlord-favourable market. Therefore, we always recommend tenants begin their searches as early as possible and keep an open mind when considering their options.

Further information

Contact Savills Tenant Representation

.jpg)