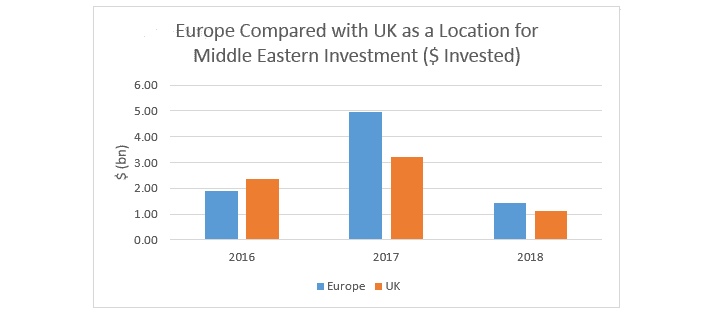

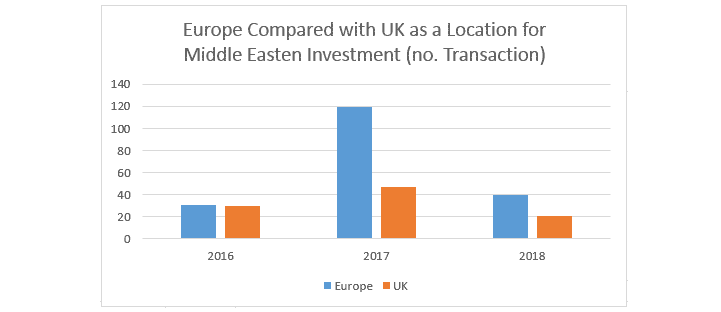

It’s a small but significant difference, both in total numbers and asset classes, but while Middle Eastern investors continue to favour the UK, they are even keener on continental Europe.

Middle Eastern investment into the UK in 2016 totalled approximately $2.37 billion (£1.8 billion), increasing to $3.2 billion (£2.43 billion) in 2017. It currently stands at $1.1 billion (£0.83 billion) for the year to date.

Over the same period investment into continental Europe has increased from $1.89 billion (£1.43 billion) in 2016 to $4.94 billion (£3.75 billion) in 2017 and already stands at $2.52 billion (£1.91 billion) in 2018.

So what and where is this group of investors buying?

Offices and hotels in the UK remain by far the most appealing asset classes for Middle Eastern investors with recent deals including the Bank of London and the Middle East’s purchase of Moorfield’s MREFIII Fund’s 1 Atlantic Quay building in Glasgow for £55 million. Advised by Savills, this was the first major investment in Scotland’s biggest city for the largest Islamic bank in Europe.

Offices and hotels are also attractive in continental Europe with a private family office from the Middle East recently buying the MM25 office building in Rotterdam for an undisclosed price from OVG Real Estate, and Investcorp purchasing the KÖ Campus office complex in Frankfurt for around €85 million (£75.5 million) with Savills advising.

As Middle Eastern investors expand in the continent, they’re also looking at residential apartments, retail and industrial which, combined, already make up more than a third of the assets they’re investing in across Europe.

Germany dominates but movement towards The Netherlands with CEE could be next

In terms of markets, the main focus for Middle Eastern investors over the last 18 months has been Germany. However, the strong competition in Germany is driving some investors to consider options in The Netherlands, where there is a perception of finding value as the returns are slightly better.

More recently there’s been greater interest in Central and Eastern Europe (CEE). However, while assets in CEE trade at a discount to Germany, the market fundamentals are different and the reason for the discount is because of the greater risk involved.

What about the US?

The attraction of investing in the US is the non-existence of currency risk and the fact it’s a bigger market with more opportunities and less competition than Europe. Furthermore, the tax changes that have been introduced by the current administration improve the covenant of corporate tenants.

However, there are deterrents too. US interest rates have risen further and quicker than in Europe and the UK and look likely to continue rising. Asset prices are yet to respond to this and therefore appear overpriced. As a result, it seems as if Middle Eastern investors are here to stay, hedging their bets by being active both in the UK and on the continent.

.jpg)

.jpg)

.jpg)

.jpg)