The buzz around proptech, or real estate tech, has grown significantly in the last couple of years. However, for some property investors the question is largely one of ‘why should we care?’

Although proptech has the potential to transform every aspect of the industry, from the process by which buildings are bought and sold to how they are designed, most of the tech innovations that are coming on stream fastest are those focused on managing real estate more efficiently.

These include things like apps and sensors that detect how many people are in a building and where, and can turn the lights and heating off accordingly to reduce energy use, as well as giving occupiers data to help them design and manage their space more efficiently.

If buildings using these forms of proptech are more efficient they are more likely to be more desirable to tenants and thereby attract higher rents, therefore arguably becoming better assets for investors to purchase – a good reason for them to pay more attention to what’s happening in the sector. Tracking which proptech innovations are being used in which buildings today may provide a clue as to tomorrow’s strongest performing and most future-proofed assets.

The volumes of money currently being targeted at proptech companies demonstrates that the wider investment community certainly thinks that it’s going to have a transformative effect on the real estate industry.

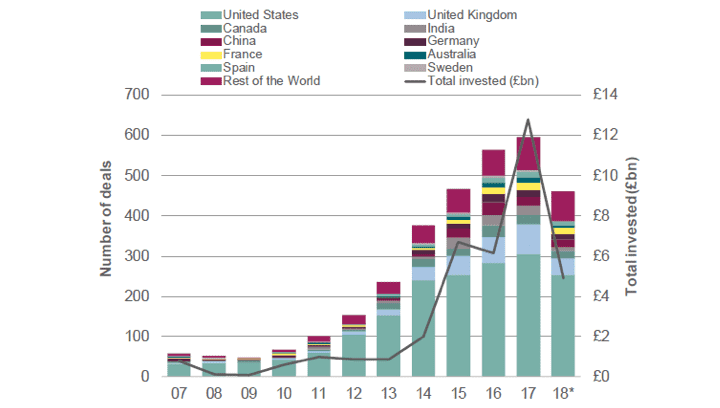

Savills has analysed the deal information for over 2,600 corporate investment transactions involving companies of all sizes within the global proptech sector over the past 10 years (see graph, below). These transactions include mergers and acquisitions, venture capital and private equity.

The US dominates the number of real estate tech corporate deals

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)