Online sales have increased 2.5 times over the past decade, reaching various degrees of penetration, from 3.5 to 5 per cent in Central Eastern and South Eastern Europe up to 15.1 per cent in Germany and even 17.8 per cent in the UK.

According to Forrester Analytics, e-commerce in Western Europe will continue to grow an average of 11.9 per cent per year over the next five years. Online sales, excluding groceries, will account for 20.2 per cent of total retail sales by 2022, from 12.4 per cent in 2016.

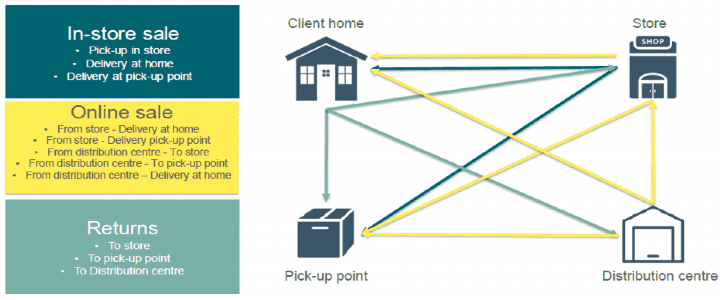

While in the past retailers used to expand their footprints by opening more stores in new catchment areas, the structural decline in in-store sales has forced many to rationalise to focus on locations with strong existing footfall. Additionally, the panoply of combinations between sales channels and delivery 'from and to' routes, has forced retailers to reorganise their entire supply chains.

Generally, retailers will have regional distribution centres near the majority of their consumers and key stores, but the booming demand for e-commerce has put pressure on their delivery strategies from these locations. In order to compete with pure online players, retailers have had to leverage their distribution centres with their stores and adopt omni-channel rather than multi-channel strategies. The standardisation of same-day delivery has also raised the stakes, forcing retailers to include smaller urban warehouses in their networks to provide quick delivery services to online customers.

Yet traditional bricks-and-mortar retail floorspace still plays a crucial role in this retail landscape, led by convenience in small catchment areas and by experience in both destination-city centres and out-of-town locations. Although it may not translate into on-site sales, physical stores are a crucial gateway for retailers to show their products and brand philosophy to customers and to understand their clientele better.

The line distinguishing the two sectors is therefore increasingly blurred: retailers generate much of their profit from their logistics warehouses fulfilling online orders, but their traditional stores drive online sales.

Clearly, the winners in this environment will be those who have been fastest to adapt. Many retailers have already invested heavily in reorganising their supply chains to fulfil omni-channel needs, but, for those that are playing catch-up, a merger or a partnership with a logistics entity could be a solution.

Investor demand for logistics assets has also grown, often at the expense of traditional retail. Logistics’ share of the European investment market increased to 13 per cent in H1 2018, up on the five year average of 11 per cent.

Rising volumes are putting downward pressure on yields. Prime logistics yields experienced the highest compression of all sector, -45 basis points (bps) year on year on average, across Europe between H1 2017 and Q1 2018. The average prime yield is at a historic low of 5.4 per cent compared with the 6.2 per cent five-year average. At the same time, prime high street yields hardened by 13bps, with the European average at 3.4 per cent; prime retail warehouse yields moved in by nearly 37bps (5.3 per cent); and prime shopping centre yields stabilised to 4.5 per cent on average.

It’s therefore not just the role of retail and logistics assets that’s blurring, but the yield gap between them too.

.jpg)

.jpg)