The retirement living and senior housing segment has seen some of the most significant activity in the healthcare market over the last 12 months. This has been fuelled by noteworthy investments into platforms within the sector by AXA and Legal & General as well as continued expansion with private equity-backed Pegasus Life acquiring Renaissance Retirement Living, making it the third largest retirement developer in the UK.

While there has been a wealth of investment and M&A activity throughout the retirement housing market, the sector has also witnessed some challenges. In particular the implications of the Mayor of London’s affordable housing strategy, which would require all retirement housing developers to provide 35 per cent of affordable homes on the same site or 50 per cent if located off-site.

The introduction of such an initiative would have substantial repercussions on the viability of developers’ schemes in Greater London. In fact, we have already seen the likes of McCarthy & Stone, Churchill Retirement Living, Pegasus Life and Renaissance lobby against the ruling, which if not successful, could result in a drop in the number of new retirement developments in the Greater London area.

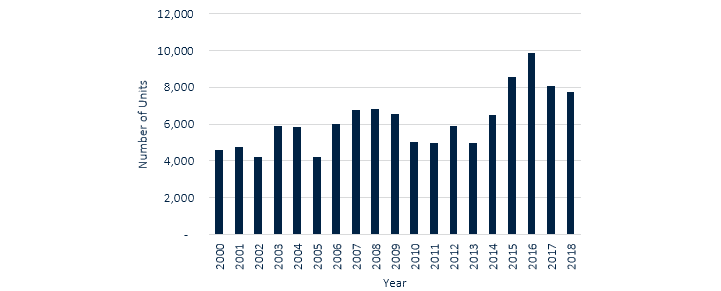

However, despite this uncertainty in terms of future development, we haven’t witnessed a dampening of interest in the sector as a whole. Instead there has been competitive bidding between developers for well-located sites across the UK, including London. Additionally, as at the end of Q2, 2018 is looking set to deliver approximately 8,000 senior housing units, which is put into context in the graph below.

.jpg)