As highlighted in Savills Impacts research programme, commercial property, although the world’s most heavily invested real estate asset class, is less than an eighth of the size of the value of all the planet’s residential real estate, totalling US $33.3 trillion in 2017.

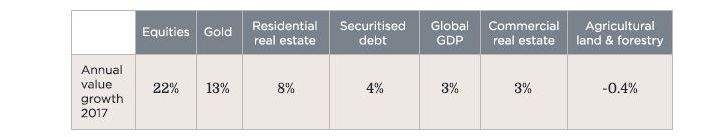

Compared with other asset values, over the course of last year equities and gold grew much faster in value than property. Commercial property lagged behind the growth in securitised debt and residential property, but faster than agricultural land in 2017. This is due to capital growth slowing following several years of strong investment and yield compression.

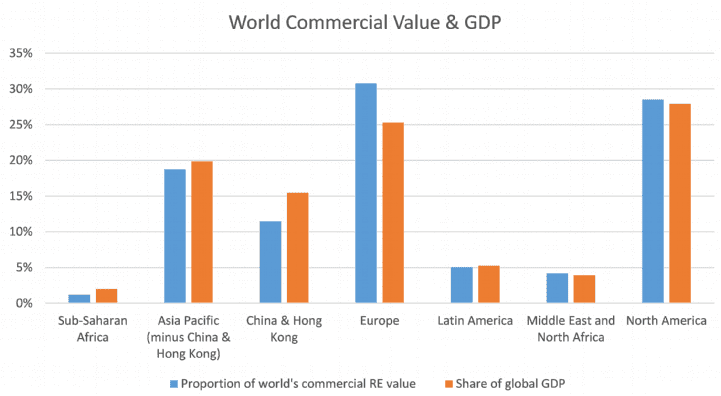

While you may assume that the size of a region’s commercial real estate market ought to be roughly be in sync with its population size, the share of commercial real estate by world region is more closely related to GDP, as the graph below shows. In 2017, commercial real estate grew at exactly the same rate as global GDP at around 3 per cent.

The relationship between world GDP share and real estate value share

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)