The average age of first-time buyers across England and Wales has risen from 27 in 1977 to 30. In London, that average now stands at 31. It’s not just a question of rising house prices putting home ownership out of reach of many. So what else has changed?

There are essentially two measures of affordability for first-time buyers. The first is the deposit cost and the second is the cost of servicing the mortgage on an ongoing basis, expressed as a proportion of income.

Between 1977 and 1997, the UK mortgage market became progressively more relaxed as financial institutions competed to lend against property. First-time buyers were able to borrow increasingly high multiples of their income at generous loan-to-value ratios, meaning deposit requirements were relatively low. So, despite the median mortgage rising from £8,376 to £41,800 over the 20 years, the average first-time buyer deposit was just £2,200, with no material difference in the relative cost of servicing a mortgage.

The next decade changed things dramatically. Strong house price growth meant the average deposit grew fivefold. Not only did first-time buyers have to borrow increasing multiples of their income as house price growth outpaced wage inflation, but the required deposit shot up from 12 to 37 per cent of their annual earnings.

By 2007, price growth had begun to make it harder for first-time buyers to get on the housing ladder, but an increasingly competitive lending environment and the prevalence of interest-only mortgages meant borrowers were able to service average mortgage borrowing of 3.36 x income. The cost of repaying a mortgage had become much less relevant than in the past. And even though interest payments as a percentage of a borrowers’ income were relatively high in historic terms, they were nowhere near the levels they had been in the early 1990s.

The credit crunch changed all that. It is now much more difficult for first-time buyers to save enough money for their deposit and this has become the overriding affordability constraint. By contrast, ultra-low interest rates have meant that the costs of servicing the mortgage on a monthly basis has been much less of an issue, despite the almost complete dominance of capital repayment mortgages.

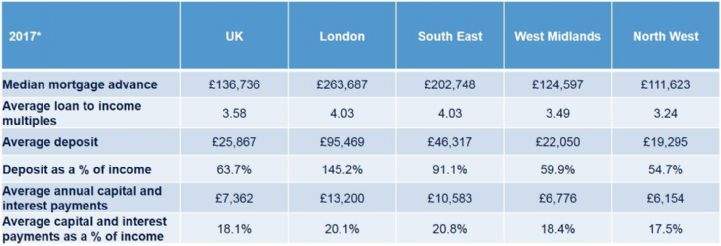

Of course, there are regional differences. In London and parts of the South East, first-time buyers have begun to hit up against the limits of mortgage regulation. Stress testing of affordability has essentially capped the amount they can borrow relative to their income, leaving them with very high deposit requirements.

That begs the question as to what happens to first-time buyer costs when rates rise. A 1.0 per cent increase would push the average costs of a capital and interest repayment mortgage up from 18 per cent to over 20 per cent of income, and up to 23 per cent if they rise by 2.0 per cent. That is likely to act as a drag on house price growth, particularly in London where affordability will be most stretched.

(2).jpg)