There’s been a notable shift in investor sentiment towards Aberdeen’s commercial property market recently and 2018 could see investment volumes returning to, or indeed exceeding, the 10-year average.

The Scottish city is near unique in its abundance of long-term, index-linked, income-producing assets, that were pre-let and built between 2012-14 to satisfy demand from occupiers who had little existing stock to choose from at a time when the oil and gas sector was booming.

Global and domestic energy occupiers scrambled to have a foothold in the European energy market capital and at one point in 2013 there was only 10,000 sq ft of Grade A office space available in Aberdeen to satisfy over one million sq ft of active requirements. As such, developers could command attractive lease terms from occupiers who needed to expand and move to better quality offices in order to retain and recruit the skilled workforce necessary to compete in the industry.

The resulting strong rental growth pushed some Grade A rents above £30 per sq ft, reflecting growth of 30 per cent over two years. All this activity and rental growth in turn attracted strong levels of investment activity, driving prime office yields down to 5.5 to 5.75 per cent and putting Aberdeen on a par with Edinburgh and Glasgow.

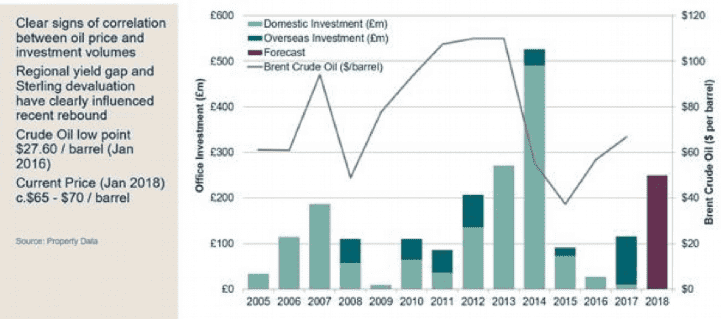

Following the crash in the oil price (which hit a low of around US$28 per barrel in 2015), Aberdeen’s property market slumped, with take-up falling and supply of accommodation across all sectors increasing. However, as the price of Brent Crude has recovered – at the point of writing in March 2018 it’s hovering around $68-$70 a barrel – the city’s office occupier market is picking up again.

This modest improvement is coinciding with a renewed interest in the city from investors, particularly from overseas Middle Eastern and US equity. This isn’t necessarily just down to a recovery in the oil price. Indeed, it’s more likely to have been sparked by the devaluation of sterling, coupled with the current soft pricing of investment stock in Aberdeen (following the oil crash), making it significantly cheaper than elsewhere in the UK.

However, the recovery in Brent Crude, and a perception that the worst is over, may continue to fuel this renewed investment activity, as shown in the chart below.

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

.jpg)