The Help to Buy (HTB) equity loan helped almost 40,000 first-time buyers across England access home ownership in the year to March 2017, accounting for around one in five new homes.

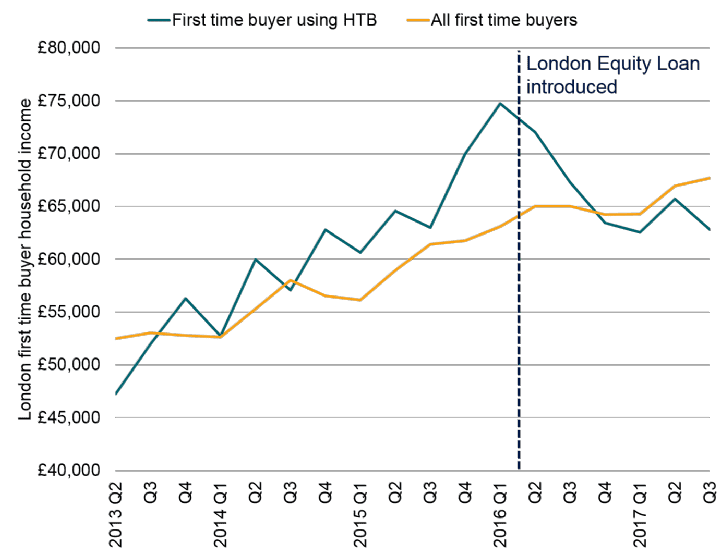

Take-up was highest in the East Midlands, where it supported sales equivalent to 29 per cent of all new homes built. By contrast, in London, where affordability pressures present the greatest challenge to first-time buyers, fewer than 3,000 buyers used the scheme, just 7.5 per cent of the total up-take across the country and accounting for only 10 per cent of all new homes built in the capital.

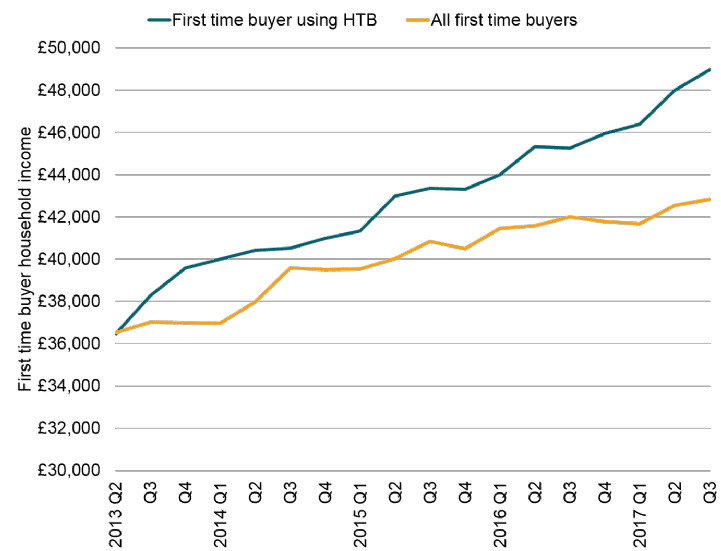

As the graph below shows, the earliest few months of HTB in 2013, first-time buyers using the scheme had the same average household income as first-time buyers as a whole. Since then, the gap has widened up a bit, and it seems likely that users of HTB increasingly include households needing family homes, with higher incomes than younger first-time buyers.

The average first-time buyer purchase using HTB in Q3 2017 had a household income just under £49,000. This is some £6,000 higher than the average for all first-time buyers across England at just under £43,000.

.jpg)

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)