Activity across Europe’s occupational markets was healthy in 2017 but somewhat limited by the lack of stock available in some key markets and low development activity which delayed some companies from making moves.

Savills therefore estimates that total office take-up for the year in the markets we monitor will have fallen by around 3 per cent compared with 2016, but still above the five-year average. Markets that were particularly busy include London’s West End, Paris, Frankfurt and Madrid.

But that’s 2017. What’s in store in 2018?

- Occupiers looking to relocate functions from London to continental Europe will continue to compete over the limited space available in destinations such as Paris, Frankfurt, Dublin and Amsterdam, as positive economic growth across the Eurozone means office take-up stays strong.

- The average vacancy rate in Europe is 7.5 per cent, a record low, with virtually no prime space available in some CBDs (Berlin, London West End, Munich and Stockholm). Existing tenants with expiring leases are likely to be faced with significantly higher rents when negotiating lease extensions.

- Companies therefore need to plan well in advance – ideally 18-24 months ahead. Starting the process 12 months in advance will probably still secure space, but due to high costs, it may not be in a first choice location.

- Attracting and retaining talent will remain one of the biggest challenges for employers in European cities this year and those that cannot meet the higher cost of prime space will weaken their position in competing for the best personnel.

- This competition for brain power will fuel companies’ desire for new types of spaces. To limit property costs larger companies may divide staff across several locations although, unlike previously when a multi-location strategy would mean shifting back-office activities to peripheral locations, a fresher strategy this year will be for companies to lease high quality space in optimal locations for ‘knowledge’ workers.

- With this in mind, the appetite for co-working, co-living, hybrid and shared spaces will continue, forcing landlords to adjust and adopt more complex operational processes. These trends are most pronounced in hubs of innovation such as London, Paris, Amsterdam, Berlin, Frankfurt, Barcelona, Copenhagen, Stockholm and Dublin.

- Co-working space providers will no doubt capitalise on the shortage of office space, continuing to become major players in the office market.

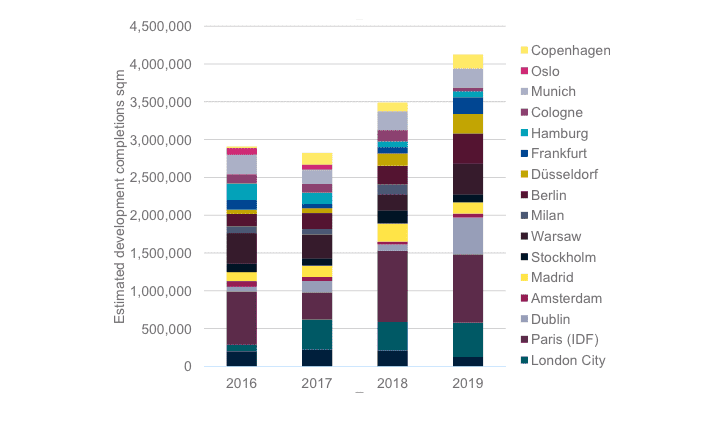

- 2018 may also include a significant amount of pre-lets. Although office completions in Savills survey area are forecast to rise by 17 per cent year-on-year in 2018 and 18 per cent in 2019, 40 per cent of this space is already committed. This will gradually decompress the tension between demand and supply.

Office development pipeline (about 40 per cent of the space in the pipeline is pre-let)

.jpg)