Speculation that the Chancellor will take a fresh look at stamp duty charges in November’s Autumn Budget is again circulating the housing market, with some buyers reportedly putting decisions on hold in the hope rates will be cut. Savills view is that this is highly unlikely unless it is part of a much wider reform of property taxation.

While the stamp duty burden on buyers at the top end of the housing market has increased significantly since the first reforms in December 2014, triggering falls in the value of high-value homes and slowing decision-making in the prime markets, the tax is proving a nice little earner for the Chancellor.

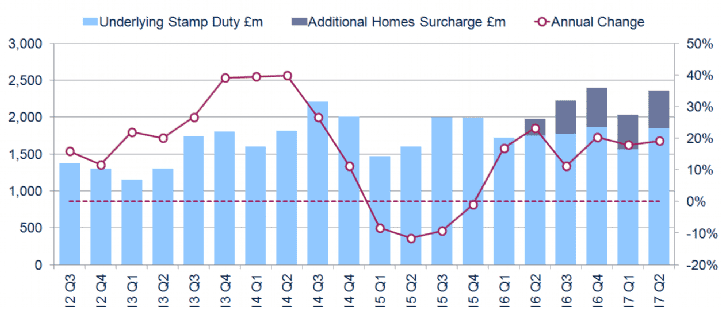

Figures published by HMRC show that overall receipts from stamp duty continue to rise. In the second quarter of 2017 the Treasury earned £2.35 billion from stamp duty. 12 months ago that figure stood at £1.98 billion, meaning earnings are up by about 19 per cent year on year (see chart below). Three years ago, receipts stood at £1.82 billion.

At the same time, sales of homes worth over £1 million have remained remarkably robust, totalling 17,700 in the past year. Sales in the £1-2 million price bracket are actually 4 per cent higher than before the major changes of December 2014, though they have softened by 8 oer cent in the past year. Above the £2million mark, sales fell by -14 per cent in the past year but have definitely not collapsed as some suggest. In the immediate aftermath of the December 2014 reform there was surprisingly little change.

Finally, a high proportion of these top-end sales are paying the extra 3 per cent levied on ‘additional homes’, further boosting tax receipts from this end of the market. Between £1-2 million a third of sales incurred the 3 per cent surcharge and above £2 million that rises to 44 per cent.

We don’t believe that autumn will bring a change to stamp duty. Rather, we think that buyers will have to continue to factor the higher rates into their budgets and sellers will have to continue to price realistically to achieve a sale as we go into the autumn market.

Quarterly Stamp Duty Receipts for Residential Property

.jpg)

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)