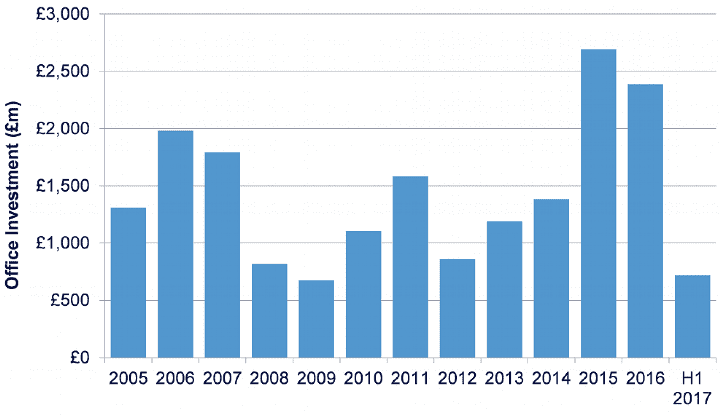

The UK regional office markets saw overseas investment exceed £2.4 billion during 2015 and 2016, and 2017 has continued to see non-domestic investment remain active, reaching £718 million as of mid-year.

.jpg)

We are often reminded of how the weak sterling has drawn overseas capital into the UK, but why is it only recently that the UK regions are reaping the benefits?

London has traditionally been the main recipient of overseas capital since 2008. During this period, 64 per cent of Greater London’s office investment was accounted for by the overseas market, whereas across the UK regions, the non-domestic market accounted for only 32 per cent.

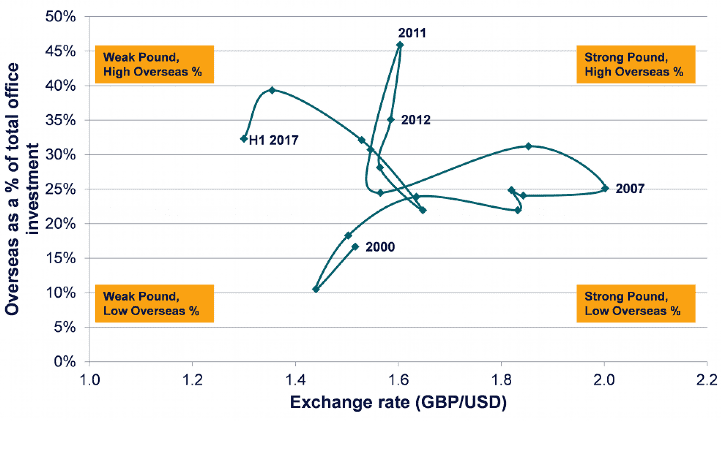

Sterling’s 12 per cent fall relative to the US dollar since the EU referendum has certainly made UK offices more attractive to overseas purchasers. However, our time series scatter chart, below, shows that there is no clear relationship between the relative strength of sterling and the overseas proportion of office investment into the UK regions. A weaker pound did not attract overseas capital to the UK regions during the early 2000s, while high proportions of overseas investment during 2008 and 2011 were also not as a result of currency fluctuations.

This suggests that the rise in overseas investment into the UK regions has been down to other factors. Non-domestic investors looking outside the Central London markets for the first time have been partly driven by the relatively attractive income on offer in the regions, compared with London and their domestic markets. Prime yields in the UK regions currently stand at 5 per cent, while City and West End yields are at 3.25 per cent and 4 per cent respectively, though they benefit from a lower liquidity risk.

Far Eastern investors, who have traditionally been more active in the London markets, acquired Green Park, Reading for £563 million last year, while HSBC Alternative Investors Limited acquired Brindleyplace, Birmingham, for £265 million in the largest regional office deal so far this year.

With resilient occupational markets, strong investor demand for secure income and an increased familiarity across the regional markets among non-domestic investors, we see increased overseas investment into the UK regions as a long term, structural change.

Further information

Read more: Prime regional office investments remain attactive in the hunt for yield

.jpg)

.jpg)