Despite a Scottish independence referendum, an EU referendum and two general elections since 2014, Scottish commercial property remains highly attractive in an income-driven environment.

Geopolitical forces have shaped the global real estate industry in the last 18 months and Scotland has had its fair share of political events that have influenced its property market. Most recently, the UK Government’s snap election which sees the first minority government in 39 years and the potential of a ‘softer’ Brexit. Closer to home, the SNP has lost 21 seats in Parliament, which could mean the possibility of a second Scottish referendum is less likely.

So what does this mean for commercial investment volumes in Scotland in the future?

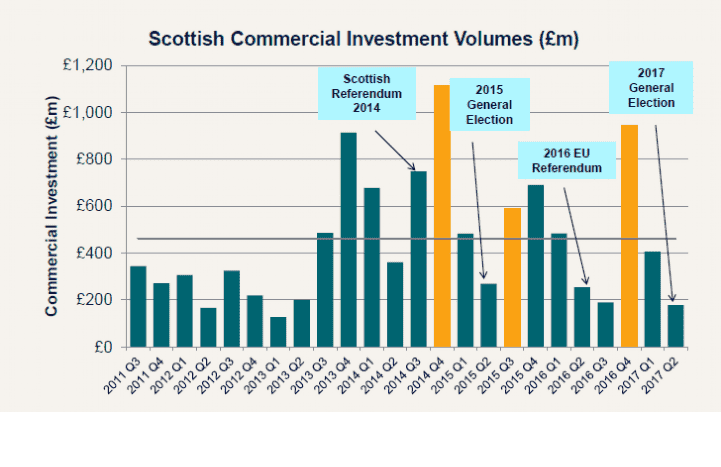

Since 2014, quarterly commercial investment volumes into Scotland have declined prior to political events, with a bounce-back witnessed (shown in orange in the graph below) in the subsequent quarters.

With landlords beginning to add stock back onto the market in Glasgow, we expect to see a bounce back in commercial investment transactions during the third quarter of 2017.

Commercial investment volumes in Scotland reached £583 million during the first half of 2017, 6 per cent below the 10-year first half average. This was due to both a shortage of on-market prime stock and the pricing mismatch between buyers and sellers. Despite UK institutions having funds to spend, they have been unwilling to meet landlords’ valuations. The round-trip costs of buying and selling have also discouraged landlords from disposing of assets at a time where returns are income led.

Overseas investors are increasingly turning their attention to Scotland, acquiring 1 and 2 & 3 Exchange Place, Edinburgh, and Cuprum, Glasgow, during the first half of 2017. We expect the weak sterling to continue to attract further overseas capital during the second half of the year. Encouragingly we are also seeing several UK pension funds returning to the Scottish market on the back of the recent election result.

As a result, Edinburgh’s prime yields for the very best office stock have moved in to stand at 5.25 per cent, from 5.5 per cent at the end of 2016. The 25-50 basis points yield gap which previously existed between Scottish office yields and the rest of the UK’s regional office markets is showing signs of closing. Investors’ improved sentiment towards Scotland relative to UK points to higher investment volumes and firm yields throughout the remainder of the year.

.jpg)

.jpg)

.jpg)