Over the past 10 years the number of British homes worth £1million, or in excess of £1m, has more than doubled, despite slipping back by 19,000 in 2016. We estimate that there are now some 394,000 £1m+ homes across the UK, due in large part to price growth in London and its hinterland.

There are a total of almost 21 million privately owned homes across Britain, out of a total of 25m. Against that context a £1m+ home isn’t exactly run of the mill, but nor is quite the benchmark it was 10 years ago. And where once outside London only a large detached rectory or farmhouse came with such a price tag, it now applies to terraced townhouses in some regional hotspots.

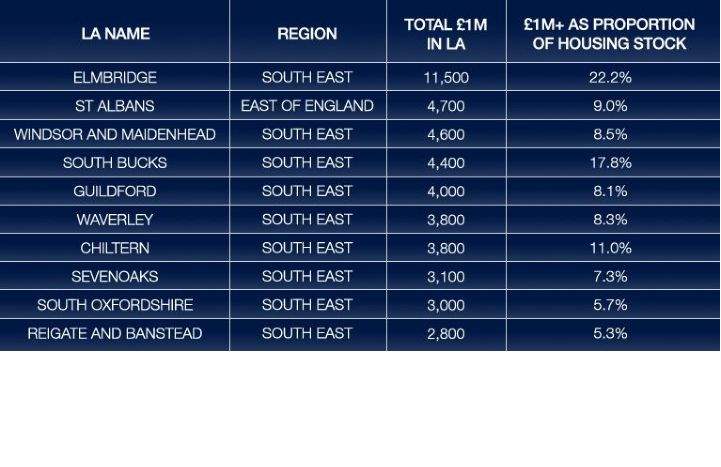

London alone accounts for almost two-thirds of these high value homes, with 250,000. A further 81,400 (20.7 per cent) are located in the South East.

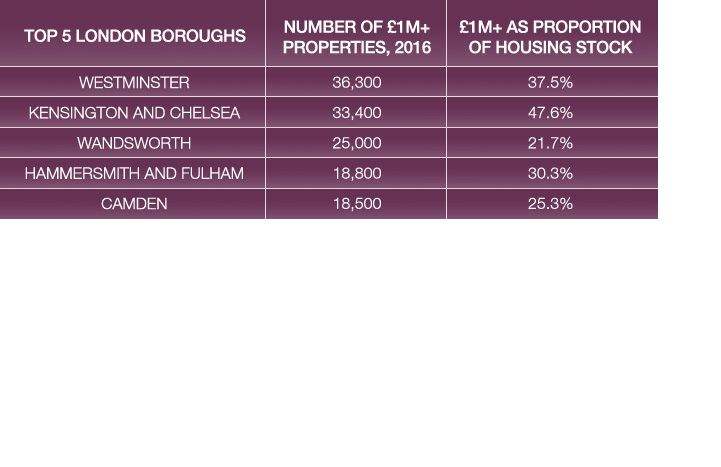

Unsurprisingly, London’s central boroughs have the highest concentration of £1m+ homes. Westminster alone has 36,300, more than all regions except London, the South East and East of England combined. In Kensington & Chelsea almost half of all homes top the £1million mark.

At the other end of the scale, Wales and the North East combined have only 1,100 of these high-value homes, reflecting the wide divide in property values across the UK.

(1).jpg)

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)