Last summer’s Brexit vote has put a spotlight on London and speculation is rife as to which European cities could benefit from businesses relocating employees out of the UK. However, our research suggests that no single city is likely to ‘dethrone’ London in the short term, but we will see a dispersal of functions to other cities.

The last six months have seen an abundance of headlines highlighting the property and labour costs involved in relocating staff to cities such as Frankfurt, Dublin, Paris, Amsterdam and Madrid; all seen as potential rivals to London. Paris and London are the most global cities in Europe, and their accommodation and workplace costs reflect their status. At the other end of the scale are Warsaw and Berlin, the cheapest of Europe’s financial ‘hubs’ to accommodate staff in Europe.

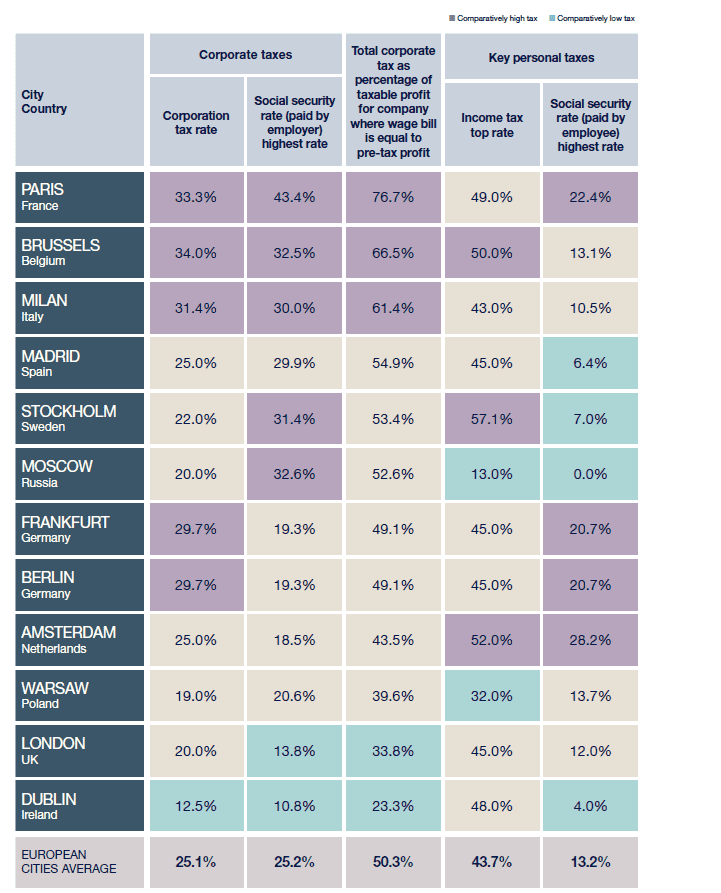

However, for organisations committed to locating employees or roles to Europe, incentives, tax and talent will be much higher up the tree than real estate costs. When you compare the corporation tax rates across these six cities, the disparity between them is significant.

(1).jpg)

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)