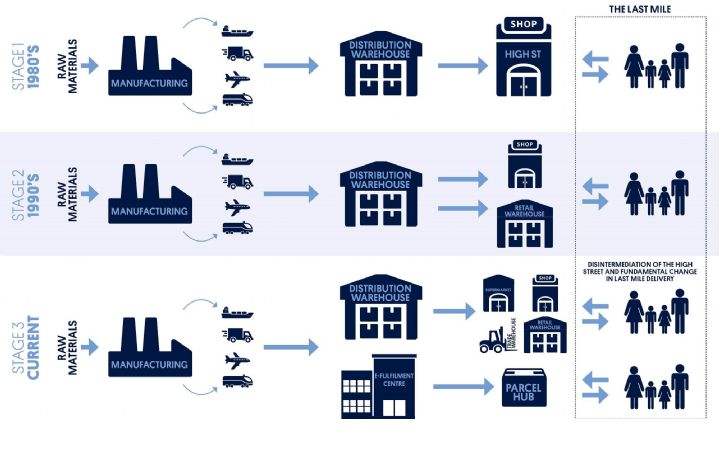

Of all property sectors logistics is the most cross border, as globalised supply chains and rapidly changing retail patterns ensure that logistics occupiers are adapting their property requirements to serve customers across different geographies.

Savills research previewed at MIPIM 2016 highlights a number of mega-trends that have the potential to impact both occupiers and investors in the logistics sector.

Firstly the 'Amazon-ification' of the retail industry will have profound implications, in much the same way as the growth of the supermarkets in the 1990s disrupted the grocery industry. In the UK in 2015 Amazon accounted for 10 per cent of all the warehouse space transacted as it looks to roll out its Amazon Prime Now delivery model across the country, which guarantees delivery within hour time slots.

The potential for Amazon to alter the grocery sector is now imminent, with it having signed a deal with UK-based supermarket Morrisons to distribute fresh food. With Amazon Prime Now recently launched in Italy and Germany, it is clear that the firm will need to take a similar amount of warehouse space across Europe to replicate this model.

This disruption will undoubtedly cause a reaction within existing retail models, and one which we are just beginning to see evolve. As we move forward there will be more mergers and acquisitions in the sector as retailer look to compete.

New retail models also demand new ways of utilising the space within the warehouse envelope and occupiers are increasingly installing expensive automation systems, which require taller buildings or taking units with structural mezzanines that alter the accepted institutional norms.

Moreover carriers such as DHL are starting to experiment with alternative designs that allow them to install an increased number of doors so they can service more delivery vehicles, which in turn require larger yards.

It's not all changing retail models however that are having an impact. Governments and major logistics companies are starting to examine and implement pilot schemes to evaluate what benefit autonomous vehicles may have on society and the wider economy.

However, the impact on logistics could be profound as centres of gravity change and drivers' hours legislation decreases in importance.

What does all of this mean for investors in the sector?

The clear change in recent times is that logistics is now seen as a truly global asset class with mainstream investors and sovereign wealth funds actively investing in the sector. In 2015 alone €10.6bn was invested in the sector, although the majority of that investment so far has been in Western European Countries, with just 11 per cent invested into CEE in 2015.

That however has the potential to change quickly as Eastern European countries become more urbanised, the prevalence of online and mobile retail increases and infrastructure improves.

One area to watch is the increasingly important returns sector. These labour-intensive warehouses are required by retailers to create order from the seemingly random returns consumers make and then incorporate them back into the retail supply chain. This will become more and more prevalent, as demonstrated by the recent announcement by Amazon that it is planning on opening a European returns hub in the Czech Republic.

(1).jpg)

.jpg)

.jpg)