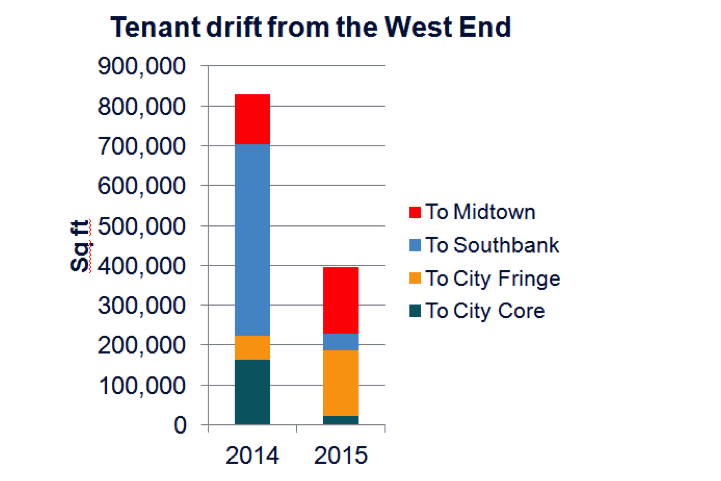

Over the past few years we’ve witnessed a noticeable pattern of tenants moving from the West End to either the City core, its fringe or other more easterly locations. Limited space in the west, combined with lower rents in the east, attracted some to make the switch.

However, in 2015 we saw this trend begin to slow. While in 2014 tenants from the West End took 827,758 sq ft of space in the east, in 2015 they took under half this – only 395,529 sq ft. Where they chose to make their home also underwent a significant shift last year. Southbank was by far and away the most popular destination in 2014, with almost half a million square foot of space snapped up by West End tenants.

By 2015 it accounted for just over 40,000 sq ft – less than 10 per cent of its total for 2014. Instead, those West End occupiers who chose to relocate moved smaller distances, favouring Victoria and Midtown.

.jpg)

.jpg)

.jpg)

.jpg)