Source: Savills Research

In the mainstream buy to let market, where debt plays a greater part in financing purchases, this additional tax will compound the effects that the mortgage interest relief restrictions will have on people’s ability to expand their portfolios. This will further push committed investors to lower value, higher yielding markets.

A recent YouGov survey of 1,000 landlords, undertaken by the Council of Mortgage Lenders, found that the restriction of mortgage interest relief would cause 13 per cent of all landlords to consider selling all or part of their portfolios, with a further 14 per cent to stop or slow the rate at which they add to it. In turn, this is likely to limit supply of new rental stock from private landlords against the context of increased demand, underpinning future rental growth.

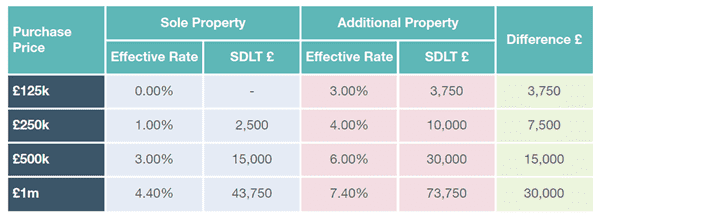

Prime markets have already been affected by successive stamp duty increases. The prime central London market and prime coastal markets are likely to be most affected, where second home buying and property investment activity is significant. As a result, they will probably remain price-sensitive over the next two years as additional costs are absorbed. Buyers of weekend properties in the country will also likely be more budget-conscious.

In the rental market we would expect investment demand to be tempered and those struggling to sell their property to be less inclined to become accidental landlords. These factors may combine to reduce private rented sector supply. On the demand side, those looking to relocate out of the capital may be more inclined to rent before they buy if they are yet to sell their London residence.

Together, these factors should underpin rents, though it is too early to say whether this will lead to significant growth.

Further information

Read our recent policy response report, visit Savills Research or view Savills Stamp Duty Calculator.

.jpg)

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)