In the UK our homes are our castles – they’re also a huge store of wealth, their total value recently passing the £6 trillion mark for the first time.

There are some 28,000,000 homes across the UK. They have a total worth of £6,170,000,000, with equity accounting for £4.8 trillion of this total, and by the end of 2015, each home had an average value of £218,474.

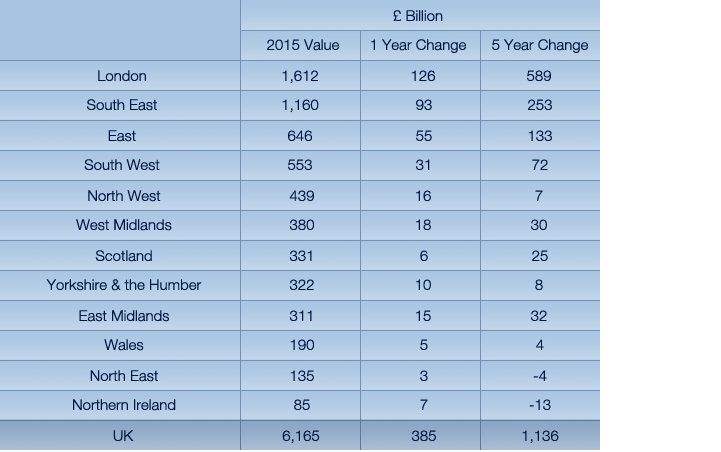

The UK’s total housing value increased by £385 billion last year and £1,156 billion in the past three years, though these post-credit crunch gains continue to favour the South over the North, and unmortgaged home owners and private landlords over homeowners with debt.

London’s 3.5 million homes have a total value of over £1.6 trillion, more than a quarter of the UK total and equivalent to an average of £330,286 per home. The capital also accounts for almost half of the total value gains seen over recent years, up by £589 billion in five years.

However, for the first time since 2010 the South of England recorded higher gains (+£179 billion) than London (+£126 billion), suggesting that price growth is now focused on the commuter zone and beyond.

Beyond London, Bristol was the standout performer in 2015, with the total value of its housing stock up £4.5 billion to £44 billion. St Albans, Reading, Wokingham and Milton Keynes also saw strong growth, while further afield, the value of housing stock in Birmingham and Manchester, the focus of much media and policy attention, increased by more than it did in 2014.

Total costs – Regional split

(1).jpg)

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)