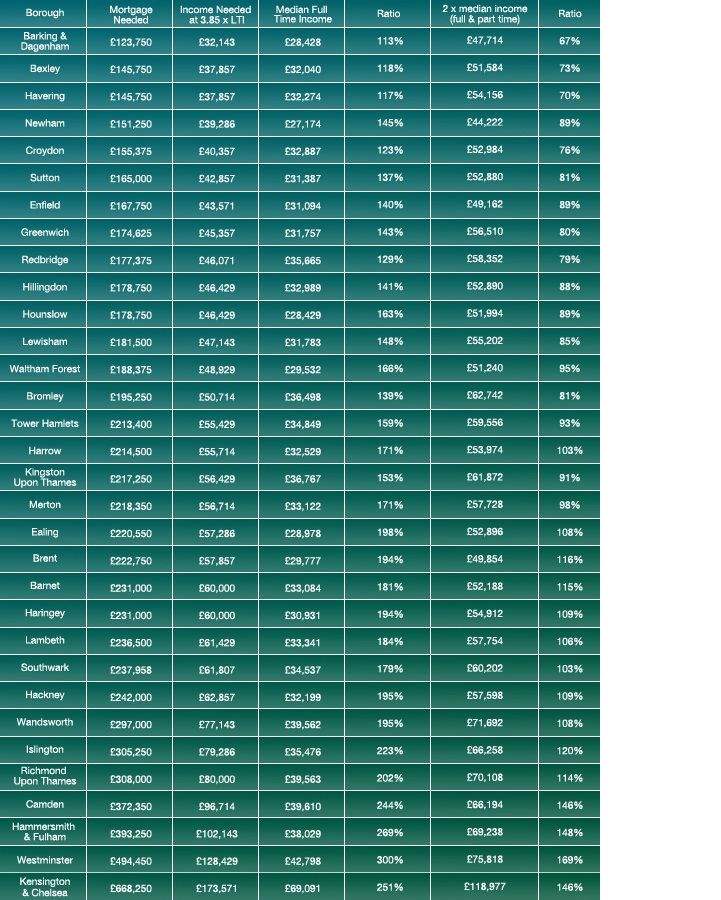

The new London Help to Buy scheme offers an equity loan of up to 40 per cent on properties valued below £600,000, with buyers required to find a deposit of 5 per cent. But how do the figures add up in a city where the average property costs around £500,000?

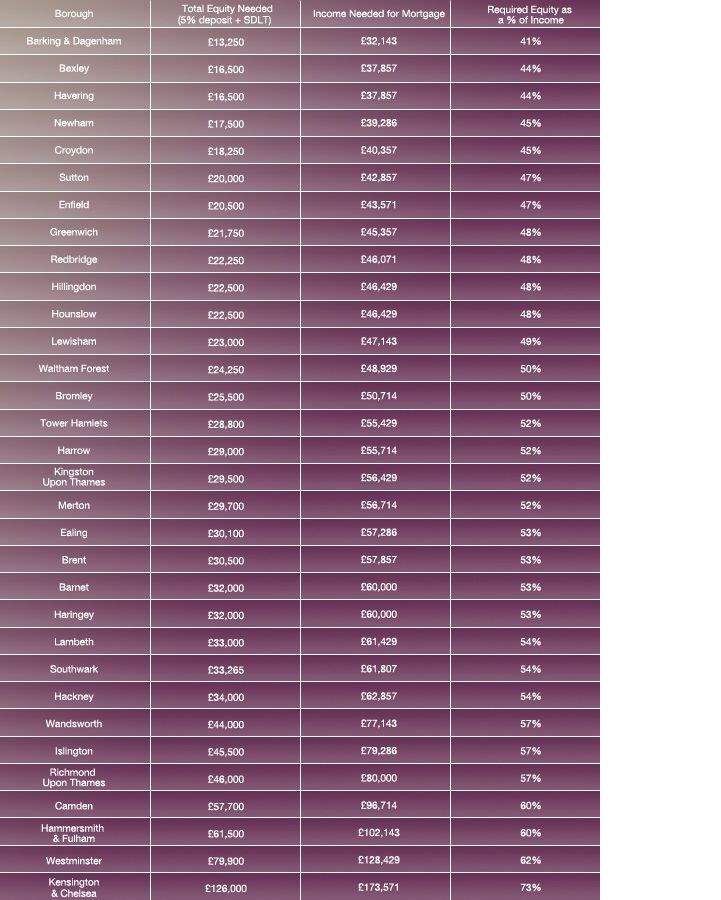

The first thing to note is that there are four boroughs in London where the median-priced home is above the £600,000 cap – namely Camden, Hammersmith & Fulham, Westminster & Kensington and Chelsea (see table below). This indicates that the scheme is unlikely to have significant uptake in these markets.

Our table also starts to show that in a number of the other high-value boroughs, the cost of the 5 per cent deposit and the stamp duty land tax will still require buyers to find a reasonably significant deposit in cash terms.

(1).jpg)

.jpg)

.jpg)

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)