The hotel market in the UK has certainly had a stellar year. While the hunt for good value has inevitably become tougher as a result, there are still excellent opportunities to be had for canny investors willing to look outside of the obvious locations.

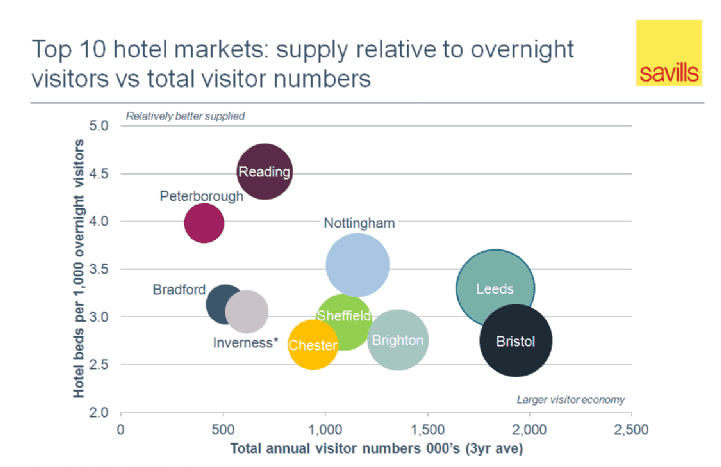

To demonstrate the point, we analysed more than 40 regional towns and cities, both in terms of the fundamentals which point to positive operational performance and investment pricing, to come up with a Top 10 (see tables below). This included a variety of economic and performance variables as well as both current and forecast bed supply relative to the size of the overnight market.

.jpg)

.png)

.png)

.jpg)

.jpg)