Since the bank base rate fell to a record low of 0.5 per cent, the affordability of monthly mortgage payments has been in a state of suspended animation. Any price growth since then has largely been absorbed by home buyers as mortgage rates have gradually but consistently fallen. However, as interest rates rise over the next five years, the cost of servicing a mortgage will become an increasingly important factor in determining the UK housing market’s prospects.

The future for house price growth is particularly sensitive to the timing and extent of interest rate rises. If rates rise quickly, prospects for price growth in certain parts of the market will quickly become limited. But if they rise slowly, there is much more capacity for medium-term price growth.

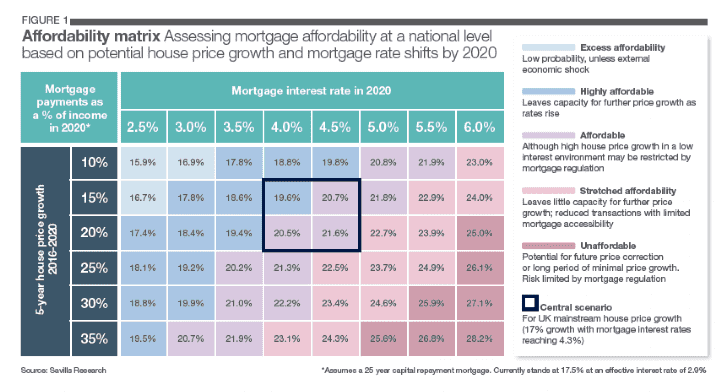

Our affordability matrix assesses mortgage repayments at a national level, based on potential house price growth and mortgage rate shifts by 2020 (see table, below). At present our situation is highly affordable, at least for those able to raise a deposit, with mortgage interest rates of just 2.9 per cent.

Using our central forecast scenario of 17 per cent national house price growth, and assuming that mortgage interest rates rise to 4.3 per cent, mortgage payments will increase but will remain affordable across the majority of the country.

However, any further house price growth or an increase in mortgage interest rates could tip us into stretched affordability territory, leaving little capacity for future price rises, reducing transaction levels and limiting mortgage accessibility.

.jpg)

.png)

.jpg)

.jpg)

(1).jpg)

.jpg)