2023: the watershed for data centre water usage

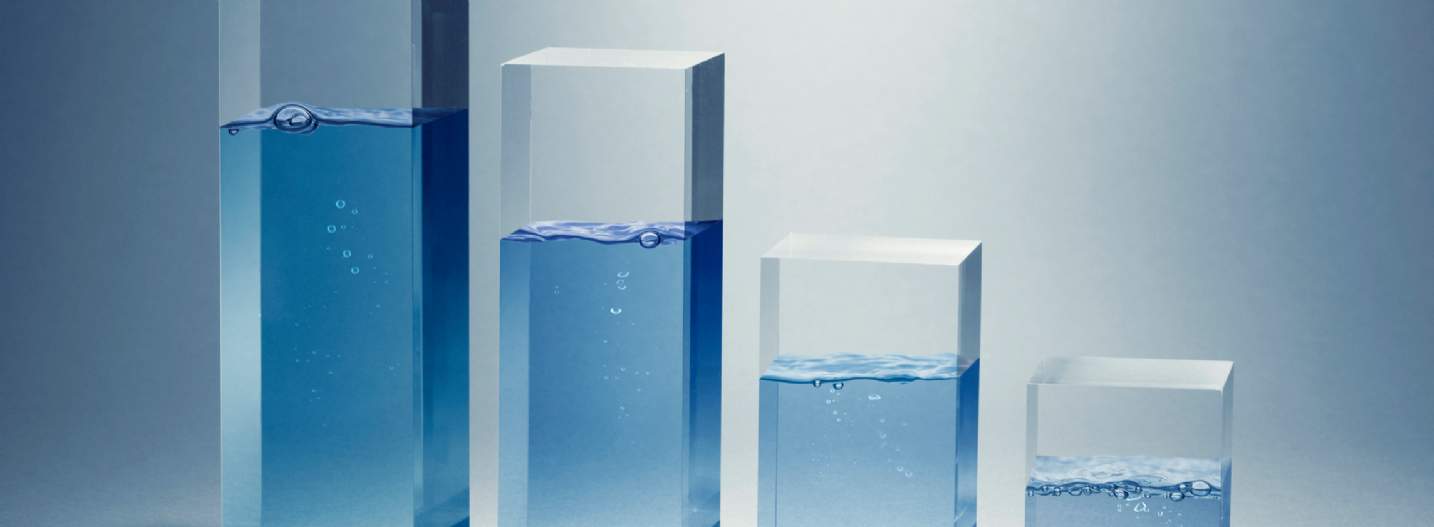

STAGE OF THE WATER CRISIS

For the past ten years, data centre operators have faced scrutiny for the huge amounts of electricity used to store digital information. In the face of climate change and amid growing concerns over the water crisis, the amount of water many facilities require to manage cooling, is coming to the fore.

Last year’s drought was the worst in 500 years, according to European Commission scientists. The European Drought Observatory reported that 63% of land in the European Union and the United Kingdom was severely affected. The water shortage has caused alarm even in countries previously considered to have an abundant water supply.

A recent satellite analysis reveals an even more concerning issue – the steady depletion of groundwater stored in aquifers across Europe between 2002 and 2022. This loss, primarily (they believe) due to climate change, is estimated to average 84 gigatons per year since the start of the 21st century.

The increased frequency of severe droughts has resulted in more groundwater being pumped from greater depths in order to compensate for the lack of rainfall, combined with record heat, thus preventing aquifers from recovering as they previously have done.

The UNCCD (United Nations Convention to Combat Desertification) predicts that by 2050, droughts may affect over three-quarters of the world’s population, and up to 216 million people could be forced to migrate. This is due to drought, combined with declining crop productivity and sea-level rise.

Growing pressure on data centre water sustainability

As the water crisis increases in severity, organisations, scientists, and associations are sounding the alarm. At the end of March this year, the UN 2023 Water Conference will occur in New York, the first UN water conference since 1977. António Guterres, Secretary-General of the UN, wants this conference to “result in a bold Water Action Agenda”.

Decisive government intervention in water usage is expected to gain momentum in the years to come. Additionally, an aggressive push for risk transparency from the investment community is also driving the increase in environmental, social, and governance (ESG) commitments. The two apparent regulations that could be considered and affect the data centre industry include:

- - Imposing a water performance certificate (WPC) measure for all public and private properties or including a cold water measurement in the current EPC rating.

- - Increasing the cost of water in the shape of an ecological tax. In Denmark, the water usage per capita was cut by half, from nearly 200 litres a day in the early 1990s to closer to 104 litres today in 2020. This drop was mainly attributed to the price of water. That said, given the current high inflation context, such a measure is unlikely this year.

Impact of the surging data centre liquid cooling market

Data centres use water to cool servers, which can have an adverse impact on the availability of local water supplies. According to Graphical Research, the total European data centre cooling market (air and liquid cooling) was estimated at $3.5 billion in 2020 and is anticipated to showcase around 15% growth rate between 2021 and 2027. The same source estimates that the Europe data centre liquid cooling market size surpassed $650 million in 2021 and is estimated to witness 20% CAGR from 2022 to 2028. Based on these figures, we estimated that liquid cooling accounts for approximately 20% of the total cooling market in Europe.

The market revenue from liquid cooling systems is estimated to witness strong growth until 2027, considering its current advantages over air-cooled systems. Whilst liquid cooling systems are more complex and expensive to install and maintain, they can provide more efficient cooling than air cooling, supporting the lifespan and performance of computer components. As such, water is increasingly being recognised as a potential risk for data centre operators, as a decreasing supply could have implications on data access continuity.

Deployment of Cooling systems can result in significant amounts of water consumption. According to reports, in 2021, the average Google data centre consumed 1.7 million litres of water per day, equivalent to 622 million litres of water annually. More generally, it is considered that a data centre uses 26 million litres of water each year, on average, per megawatt of data centre power. Based on this figure, and assuming that 20% of all the existing European data centres are using liquid cooling systems, the amount of water usage by data centres would reach 43.2 billion litres annually.

Data centre industry commitments to the water cause

Last year, the Climate Neutral Data Centre Pact (CNDCP), a self-regulatory initiative signed by 74 data centre operators and 23 associations, presented its proposed metrics for water conservation to the European Commission. The CNDCP has proposed a goal to the European Commission to cut water usage to a maximum of 400ml per kWh (400 litres per MWh) of computer power by 2040. This voluntary target is highly ambitious and demonstrates the commitment of the European data centre industry to reducing its impact on the environment.

But how can a data centre become less thirsty? Best practices for reducing water usage in data centres include alternative cooling methods (such as air cooling or evaporative cooling), which use far less water than traditional water-based cooling systems but do use a lot of energy (comparatively).

Additionally, data centres can improve efficiency by implementing closed-loop cooling systems where the same water is recirculated within the cooling system and does not need to be replenished from an external source, recycling and reusing wastewater, virtualizing servers, using energy-efficient hardware, and regularly maintaining cooling systems.

This month Google announced working on new cooling technologies that could dramatically slash the use of water in its data centre operations. It has not revealed the detail of this new technology; however, it said it is targeting to cut its water usage by half. Whilst this will not be enough to meet the CNDCP target, this would be a big achievement and the first of a kind towards water-usage efficiency improvement.

TOP WATER RESOURCEFUL COUNTRIES

For developers, operators or investors, it is important to consider water availability and security carefully before engaging in a data centre. It’s no surprise that Nordic countries are amongst the least at risk of water shortage, according to the latest data from Aquastat. They benefit from large domestic resources of water per inhabitant. Ireland, France and Italy have relatively good renewable water resources per capita and a low dependent ratio (below 10%).

Denmark, the Czech Republic, Spain, and the UK have very low dependency ratios but, at the same time, minimal water resources per capita. On the right-hand side of the graph below, Hungary, the Netherlands, Romania, Luxembourg, and Portugal have limited water supply which strongly depends on water import.

In the future, these factors will all play their part in the decision-making process of a data centre developer, alongside the usual ESG considerations. Water will become an increasingly pivotal element when deciding where to build.