South Korean investment acquisitions in Europe hits record €6.2bn in H1 2019

What has happened?

2019 has already been a record year of South Korean investment into Europe, with €6.2bn acquired in the first half of the year, and a further €1.5bn acquired in July 2019. At mid-year, this already exceeds the previous full-year record set in 2018 by 13%. What’s more, South Korean investment has accounted for 10% of all cross border investment into Europe during H1 2019, up from 3% during 2018. So what has made European commercial property so attractive to South Korean buyers?

Why?

In many respects, the last two years have provided the perfect storm for the growth of South Korean Investment into Europe. Firstly, South Korean sovereign wealth funds have increased their allocations to alternative investments, including real estate. This has created a need to diversify real estate portfolios into Europe, and the most favoured markets have been those with the lowest volatility in returns, particularly the core Europe office markets.

Given the rising political risk surrounding a China–US trade war and demonstrations in Hong Kong following the proposed extradition bill, Europe has become relatively attractive for those investors in search of long income and lower sovereign risk, with South Korean investors placing a great deal of importance on national credit ratings. Indeed, South Korean investors have been relatively undeterred by the ongoing Brexit negotiations and acquired €2.2bn worth of UK commercial property in 2018 and a further €1.4bn during H1 2019. What’s more, the shortage of available investment opportunities domestically has accelerated the rush to Europe.

This year, however, Paris has dominated the headlines for South Korean investment. By July 2019, €4.4bn has been acquired or under offer in the French capital which has been driven largely by the positive carry on the euro and cheap debt. South Koreans are currently able to borrow French debt for c.100–120 bps pa, whereas UK debt costs in the region of 250 bps pa, which helps to justify prime office yields in the region of 3% in Paris CBD and 4% in London City.

Koreans are currently able to borrow French debt for c.100–120 bps pa, whereas UK debt costs in the region of 250 bps pa

Savills Research

Paris’ status as a global city provides a higher level of liquidity, low office vacancy rates and a wide-ranging tenant mix. South Koreans have acquired Lumière (€1.1bn), Tour Europe (€280m) and CBX (€450m) in the first half of 2019.

South Korean investors require a cash-on-cash in Korea of 7.5–8%. This translated to a cash-on-cash in Europe of 6–6.5% with typically 60% leverage before the 120 bps currency hedging premium between the euro and won. The hedging premium has begun to tighten in recent months and now stands at around 70 bps. This may dampen South Korean appetite for European real estate in 2020 although the hedging impact is being softened by ever-decreasing financing costs in the Eurozone.

How have the Koreans acquired European real estate?

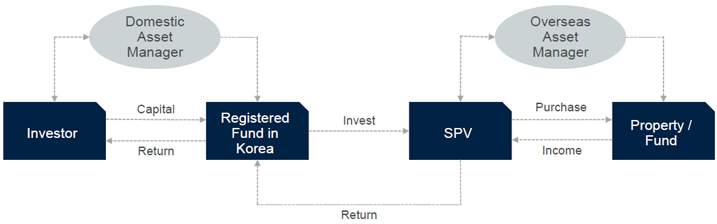

South Korean investors need a domestic asset manager company (AMCs) to register a fund in Korea which invests in an overseas special purpose vehicle (SPV) usually designed to last for five to seven years to acquire each asset. This is overseen by an overseas asset manager based in Europe. Acquisitions are made by the large South Korean security houses and shares are sold down to the ‘ultimate’ domestic investors (see below).

South Korean acquisitions of European real estate

Source: Savills Research

What next for the Koreans?

Given higher levels of exposure in London and Paris, what will be the next investment themes for the Koreans?

1) Region

South Korean investors have shown signs of willingness to invest outside the European core cities to take advantage of more attractive yields on offer, but are still sensitive to long income on strong covenants. Strong sovereign credit ratings will see increased inward capital flows to the Nordic cities, however, this will be influenced by the currency hedge to Swedish krona. Euro-denominated cities including Helsinki and Dublin are likely to benefit more immediately, along with Copenhagen as it is pegged closely to the euro.

Central Eastern Europe, has been attractive to South Korean investors and we have seen a flurry of deals in the region in 2019 including South Korean REIT, JR AMC acquiring Budapest office, Nordic Light Trio from Skanska for €41m. Likewise, AIP AM acquired newly developed Twin City Tower, Bratislava for €120m from HB Reavis, mostly let to Amazon on a long lease. The yield arbitrage between CEE and Western Europe has started to reduce in recent months and this could begin to dampen Korean appetite for further transactions if this downward yield trend continues.

We are also seeing resurgent European equity becoming increasingly competitive in their bidding against the South Korean investors in most of the regions in Europe, particularly for the sub-€200m lot sizes.

One point of note is that Koreans are keeping a close eye on the US and if the Fed starts to cut rates in 2020, then it is likely that Korean investors will refocus their attention away from Europe to the US.

2) Sector

88% of South Korean investment into European real estate during H1 2019 has been in the office sector. Outside offices, European prime industrials offer an attractive yield following strong e-commerce growth. Online retail is forecast to account for an average of 15% of total retail sales in Western Europe by 2023, up from 10% at end 2018, according to Forrester. Sufficient lot size, lease length and covenant strength will be the key determinants for South Korean investors. IGIS Asset Management has recently launched South Korea’s first public fund investing in logistics centres, the Neptune Portfolio, targeting to raise up to 245 billion won to acquire three Amazon fulfilment centres in Barcelona, Paris and Bristol.

3) Style

As the core gateway cities of Europe continue to evidence compression of prime yields and ever-competitive domestic investment markets, Korean investors have started exploring more creative strategies through which to achieve their required cash-on-cash returns. Whilst diversification into more peripheral markets and new asset classes goes some way to affording the means of fulfilling their key income return requirements, there is also a growing willingness amongst Korean investors to approach more innovative structures, including co-investment alongside seasoned European asset managers.

Korean investors have started exploring more creative strategies through which to achieve their required cash-on-cash returns

James Burke, Regional Investment Advisory

Through a so-called Preferred Return Model, European asset managers would typically take a minority stake of 15–30% in an opportunity, agreeing to pay passive South Korean investors, who take on the position of majority equity partner, a fixed cash-on-cash return from the incoming cash flow. By ensuring regular income and insulation from any potential volatility in revenue, this structure enables Koreans to broaden their scope of investment in Europe, targeting asset classes which would previously have been deemed too insecure. Adoption of the structure permits European asset managers to harness attractive value upside potential in sectors where they boast bespoke expertise whilst allowing Koreans to adapt and grow within an increasingly competitive European real estate space.