.jpg)

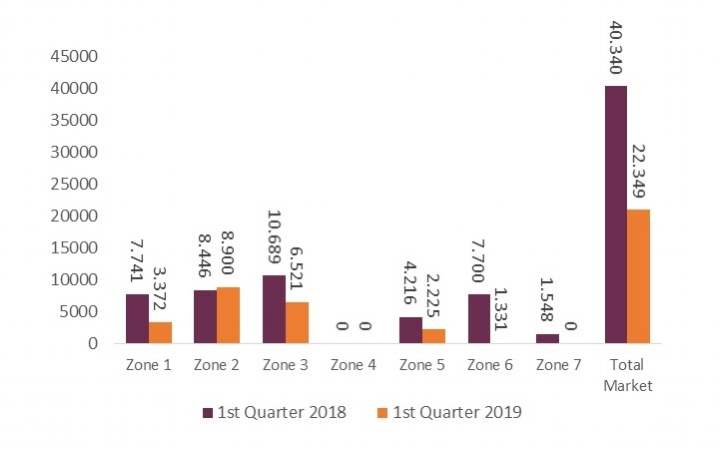

Closing results of the 1st Quarter of 2019 show, once again, a fall in activity in the office market in Lisbon.

In the end of the first quarter of 2019, the office market in Lisbon recorded a take-up of 22 349 sq.m. In comparison with the same period of 2018.

In the end of the first quarter of 2019, the office market in Lisbon recorded a take-up of 22 349 sq.m. In comparison with the same period of 2018, this result shows a drastic fall in activity of 44.6%.

Apart from Zone 2 (CBD) which had a growth of 5,4% in the take-up, all other zones in the market recorded a smaller take up for the quarter, with Zone 6 (Western Corridor) and Zone 1 (Prime CBD) accounting for the greatest decrease of 82,7% and 56,4% respectively.

GRAPH 1 | Absorption Volume (sq.m.)

Source: Savills Research/LPI

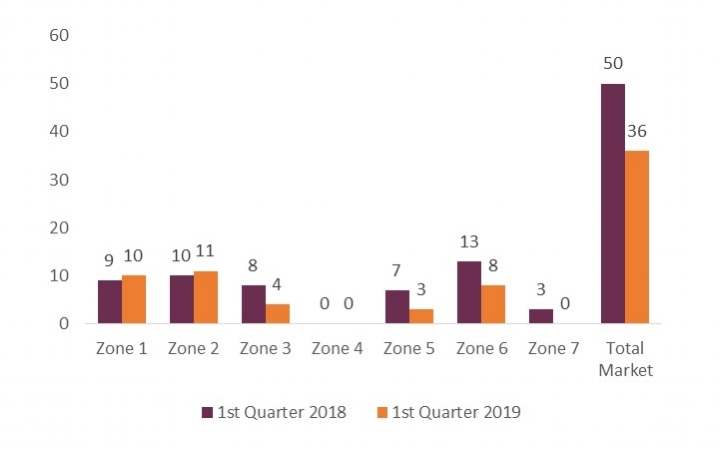

Overall, in the first quarter of 2019, there were 36 transactions, which represent a decline of 28% comparatively to the number of transactions of the 1st Period of 2018.

It should be noted that Zone 1 (Prime CBD) and Zone 2 (CBD) had a rise of 11% and 10% respectively in the number of transactions.

GRAPH 2 | Number of Transactions

Source: Savills Research/LPI

The numbers show a kick-off of a shy year for some zones in the market, which had reached high levels of activity along 2018. This is the case of Zone 6 (Western Corridor), which had 8 operations in 2019 that accounted for 1 037 sq.m of occupied office spaces.

This performance contrasts with a sum of 13 operations and a total of 7 000 sq.m that were occupied between January and March of 2018, which highlights the decreased dimension of occupation activity in the office market.

The biggest transactions of the 1st Quarter of 2019 corresponded to a take-up of 3 579 sq.m in Entrecampos 28, occupation in José Malhoa 22 of 2 699 sq.m from Cimpor and a lease of 2 289 sq.m from Everis in José Malhoa 19.

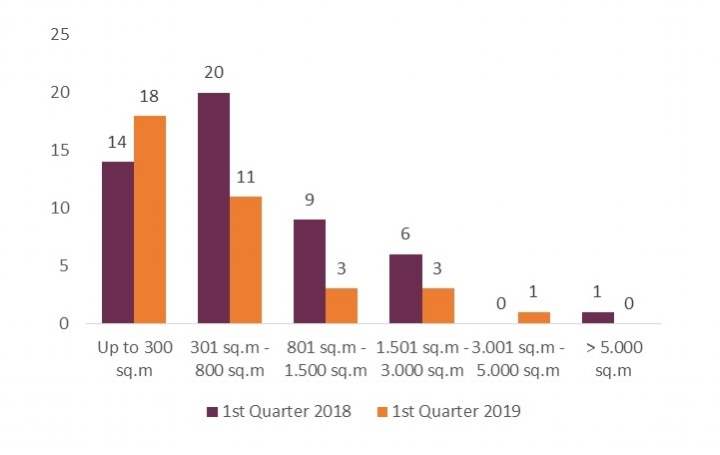

GRAPH 3 | Number of Operations by Area Range

Source: Savills Research/LPI

Once again, the market proves the tendency for greater occupation of areas between the intervals <300 sq.m and between 301 sq.m and 800 sq.m.

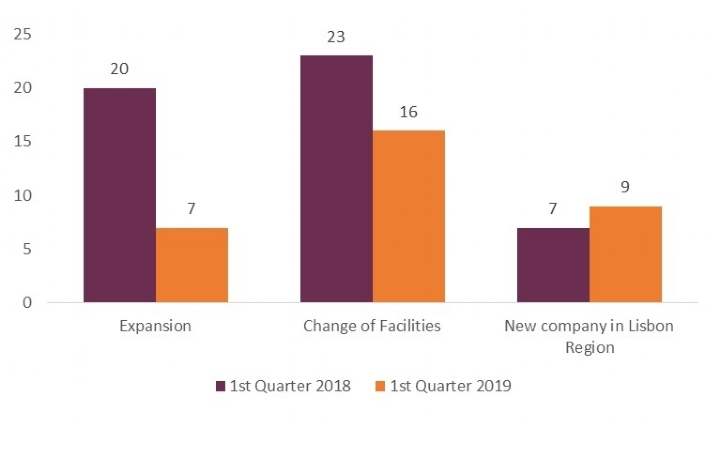

Despite the lack of supply being directly connected with the fall in activity of the office market in Lisbon, the demand continues to demonstrate dynamic as there is a growing interest of firms to expand their services in or into the city of Lisbon. Relocation remains the leading motive of the transactions and represents the momentum the market has in the making of new projects and increased performances of firms.

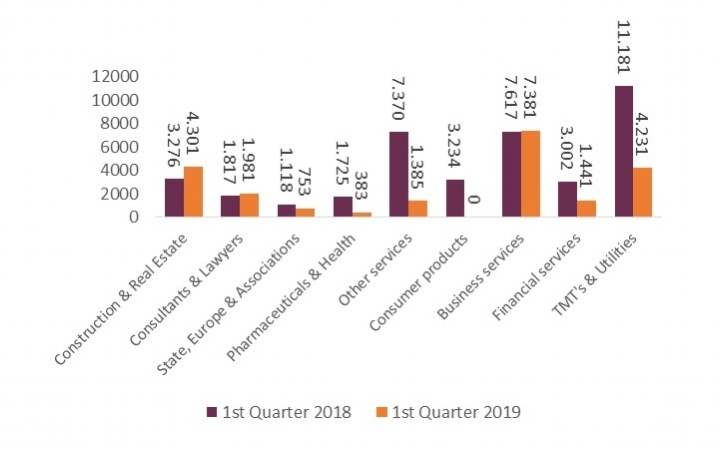

The sector TMT’s & Utilities stands out as the most active business sector in the office market, which goes accordingly with the investment coming into Lisbon as a technological and entrepreneurial ecosystem.

GRAPH 4 | Absortion Volume by Business Sector

Source: Savills Research/LPI

GRAPH 5 | Reason of Operation

Source: Savills Research/LPI