.jpg)

Month of April confirms downturn of Lisbon’s office market.

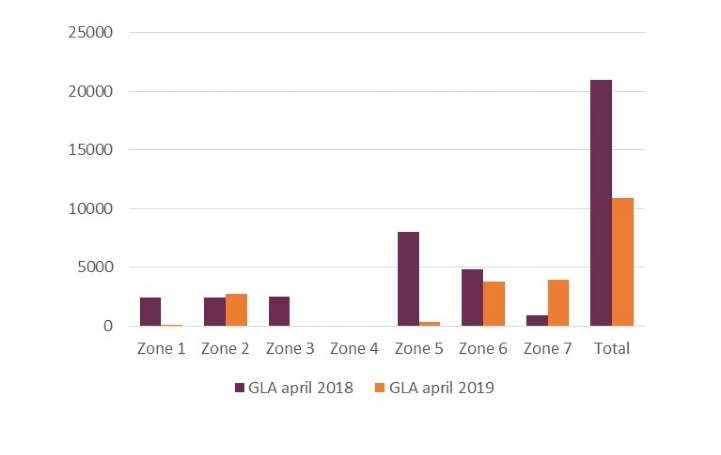

The placement of 8,000 sqm in a single operation in April 2018 inflated the value of the comparative period

Rodrigo Canas

The month of April registered a fall of about 50% compared to same period in 2018, which is an inverse dynamics when compared to the month of March, that has shown an increase in the same proportion. In the total accumulated from January to April, we also noticed a less pronounced decrease (15%). Altogether, 10.887 sqm were placed with special emphasis on zones 6 (West Corridor) and 7 (Other Areas), which represented 71% of the total area.

“The placement of 8,000 sqm in a single operation in April 2018 inflated the value of the comparative period, and it is very difficult to carry out transactions with this dimension in the current scenario" says Rodrigo Canas, Associate Director of Agency Department from Savills Portugal.

GRAPH 1 | Absortion Volume by Market Zone

Source: Savills Research/LPI

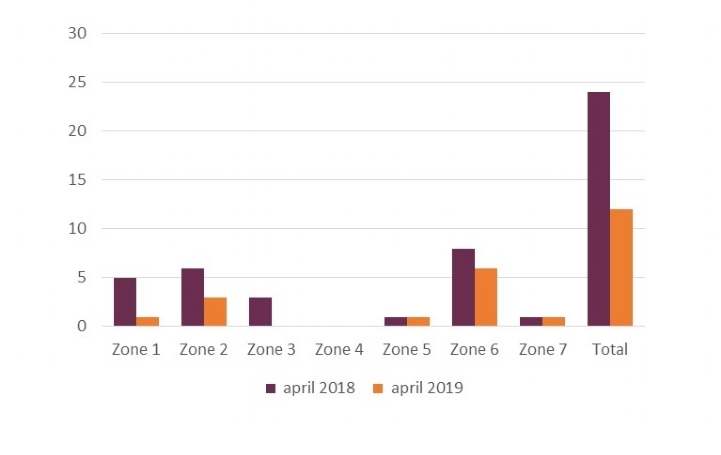

GRAPH 2 | Number of Deals

Source: Savills Research/LPI

12 deals were closed in April 2019, which represents half the deals registered in the same month in 2018.

Zone 6 continues to be the primary destination for office spaces, with 6 transactions totaling 3,781 sqm, only surpassed by zone 7, which absorbed 3,928 sqm on a single transaction.

The low market supply that matches the demand’s criteria (especially regarding size of area) explains the absence of any operation in zones 3 (Emerging Zone) and 4 (Historic Zone); zone 2 (CBD) increased by 12%, explained by the high demand (broad to the entire Lisbon market), but in particular by the good access, the diversity of activities carried out and space versatility (from smaller to larger areas).

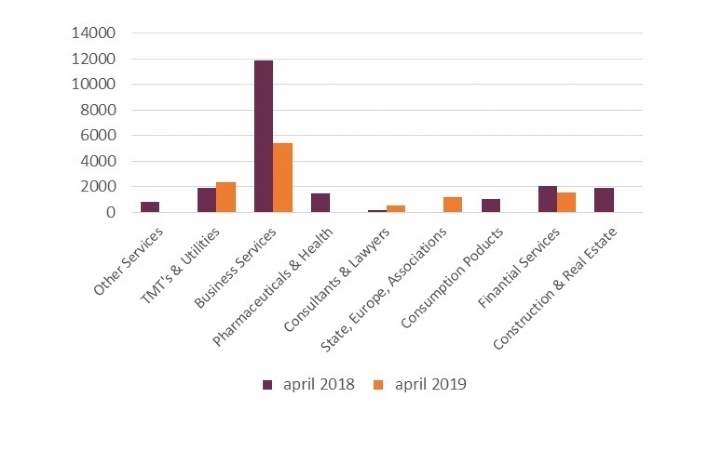

GRAPH 3 | Absorption Volume by Business Sector

Source: Savills Research/LPI

The Company Services and TMT's & Utilities business sectors were the most active ones, occupying 5,415 sqm and 2,356 sqm respectively, which proves that they continue to be the main drivers of the office market in Lisbon. Despite the reduced stock, it continues to merit the attention of the most varied multinational companies.